The Bitcoin Review was the previous incarnation of my newsletter.

2021.25 - In Memoriam

First National Airdrop || Azteca Pushing for Bitcoin || The Talk || Exodus || 50 shades of Rug Pulls || Tether Heating Up || Cantillionaires

TLDR:

Whatever else this year has brought, one almost universal experience for most has been loss. Whether it was money, health, freedom, friends or enemies, there has been reason for mourning.

Stack Patiently.

THE STANCE

My personal opinion on where the ball might be heading.

1,000,000 Bitcoin

It’s been reported Mircea Popescu recently drowned in the sea in Costa Rica.

I’m not one to eulogize Popescu. He belonged to a different Bitcoin era than me and I only learned of his existence a few months ago. Despite my curiosity around how he came to own a million Bitcoin, I never really managed to dive into his blog or learn much about the man.

He does seem to have left deep marks on the early Bitcoin community, not all of them good.

40-Year old Popescu would have been worth a staggering 30 Billion or more today. News of his death made me grateful to have a little more time.

RIP MCafee

John McAfee allegedly committed suicide after learning his extradition to the US from his Spain had been approved. His wife denies he was suicidal. John claimed to have a trove of incriminating documents that would be release if he met an untimely fate

An Ethereum wallet that is believed to be McAfee’s executed some transactions after his death was announced… Whatever else one could say of John, he was never boring. May he rest in peace.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

El Salvador

First National Airdrop

The people of El Salvador will receive US $30 to their wallets, marking the first time in history that a government will “airdrop” (give away) Bitcoin to its citizens.

President Bukele delivered a widely praised address (original in Spanish below) in which he detailed the spirit and specifics of the recent Bitcoin law, addressing some of the many concerns his citizens have been voicing after the recent law was passed in a rapid manner.

Billionaire Thangs

Azteca Pushing for Bitcoin

After a recent interview in which he demonstrated a solid understanding of the basic investment thesis for Bitcoin, Ricardo Salinas Pliego —Mexico’s third richest man who had previously disclosed he has 10% of his liquid assets in Bitcoin — dropped some surprising news in a casual conversation with Michael Saylor:

“Bitcoin should be part of every investor’s portfolio”

—Ricardo Salinas Pliego

The Talk

Jack Dorsey announced “The B Word” an event to help institutions embrace Bitcoin. After the announcement some friendly-if-childish banter led to Elon Musk accepting Jack’s invitation to come and discuss all things Bitcoin.

I’m not holding my breath about Elon’s role regarding Bitcoin becoming a net positive, but if he could be convinced to not add further damage that would be great.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Exodus

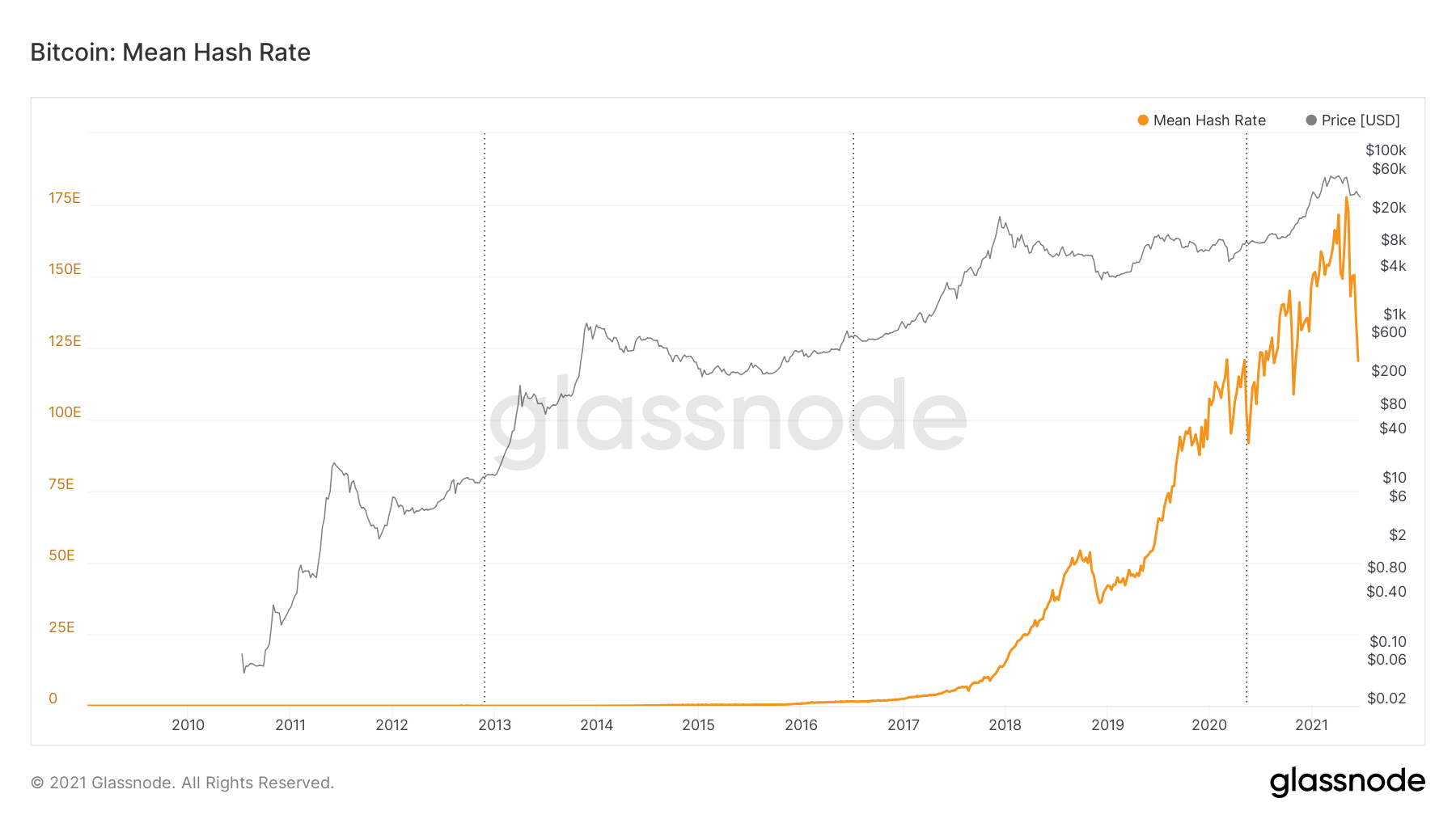

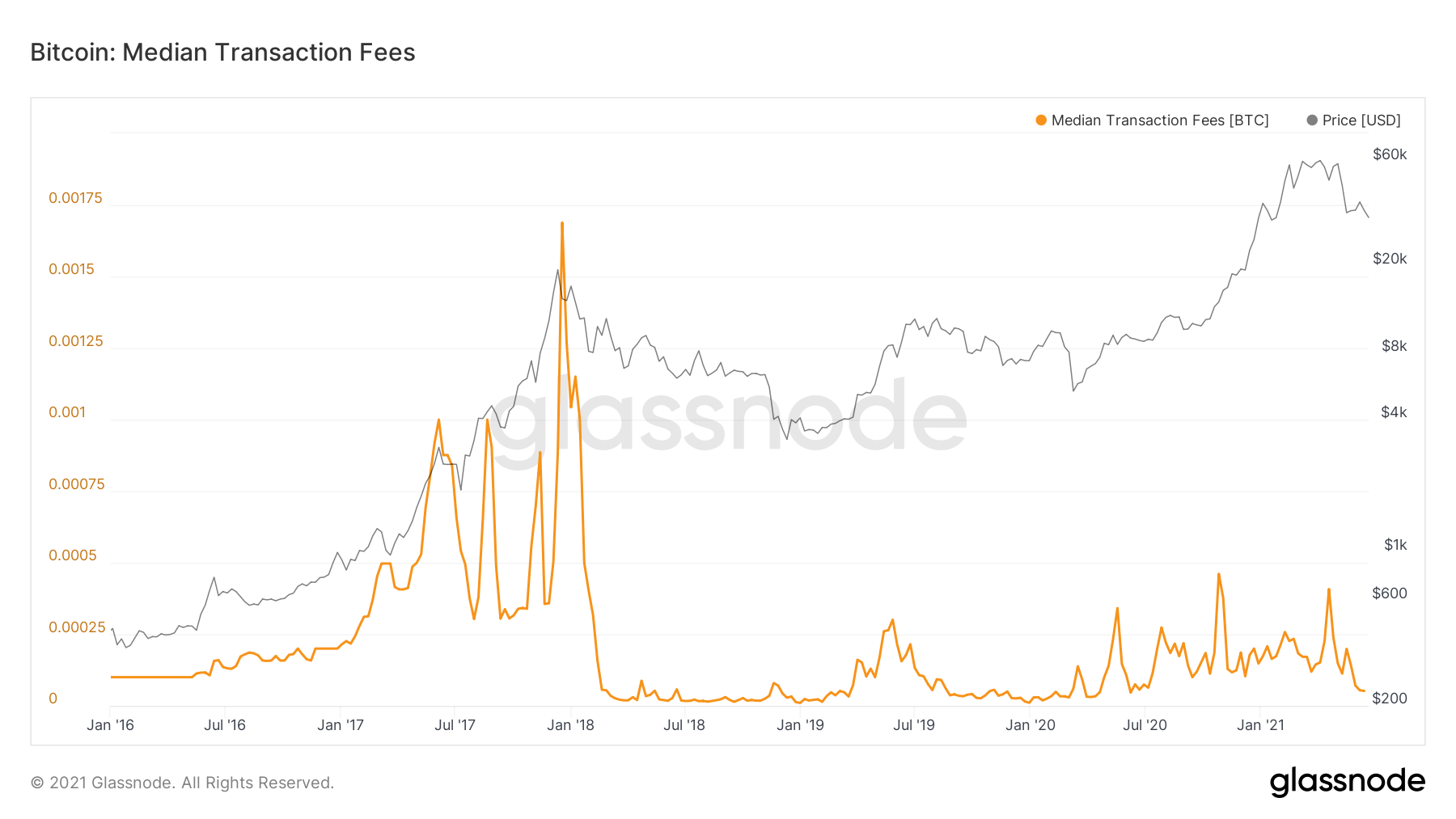

Hash rate continued to drop as Chinese miners prepare to migrate, however transaction fees not been impacted.

It’s hard to know what China is really planning at any given moment. Speculation abounds about whether they are really committing a huge blunder or playing some version of 4D-chess. The narrative being pushed is that China is trying to limit access to risky financial speculation:

There have also been questions about the extent to which this miner migration is affecting the price of Bitcoin

50 shades of Rug Pulls

The best way to understand the concept of a “rug-pull” —a fairly common occurrence in “crypto” (aka shitcoinery) and one of the reasons I advocate a Bitcoin-only portfolio— is through an example or two, (or three). While the basic dynamics are the same, they can come in various flavors:

Cuban Rug

Let’s assume you are a fictitious billionaire named Mark with a large Twitter following, you tell your followers you are investing in an asset which has been rising rapidly. As your followers decide to get in on the trade you and your insider friends sell your entire positions for a hefty profit, cratering the price of the asset:

In order to be able to do it again you must claim to be one of the victims. Bonus Points if you add insult to injury by brazenly calling for regulations to stop this kind of thing from happening.

Pal Rug

This method takes a lot of work, you need to build a platform to which people come for advice / learning. Obviously you have to provide some value in order to attract an audience, but in between your nuggets of wisdom you lend credence to scammy projects by giving them airtime and acting impressed at their potential Bonus points if you charged the scammers for appearing and/or the marks the audience for accessing the content)

In order to be able to do this more than once you need to feign ignorance about the technical workings of blockchains and focus exclusively on the marketing narrative.

Love Rug

This one is rare because it makes the least sense. It starts with you genuinely loving Bitcoin and working really hard to promote it in earnest.

But the lure of free money beckons. Except this money isn’t free. It comes at the potential cost of your reputation.

You see, a team recently created a run-of-the-mill altcoin with a twist: it’s value goes up and down along with your “reputation” and if you want to claim your money you have to do so publicly on Twitter, hereby marketing the product however reluctantly.

You can read his verbose description of the “ordeal”

Here’s how I interpreted it in real-time:

Robert tries to unlock his Bitclout profile to dump the coins, but bungles the link and the profile remains unclaimed:

Facing backlash, he assumes a defensive stance

He “tries to warn” his upcoming victims in an an oblique manner:

By one account, Robert Breedlove decided to do just that. He claimed his profile, received his tokens and sold them for Bitcoin. Personally, I don’t have much of an issue with that. BUT the devil is in the details.

The problem —for me— was that instead of doing it brazenly he “asked permission” first, when confronted with the implications of what he was about to do he tried to cloak the whole thing under a disingenuous guise of free intellectual inquiry, villified the community (including former friends) for trying —in their own admittedly toxic and overboard way— to prevent him from committing reputational seppuku, pulled the rug (for a little over $30k to be donated to Bitcoin developers) and came out of the ordeal claiming both victimhood and moral victory in a looooong essay.

The whole thing was sad to witness.

While I agree that Bitcoiners can go overboard in their race to be most toxic and I support the need to remain inquisitive, Bitclout was fairly obviously not a deserving hill to die on. We should not pretend otherwise.

I hope Breedlove is able to return to the Bitcoiner community one day, but the latest interactions I’ve seen leave me with little hope of this happening.

Finally, the denouncement of toxicity is a requisite of all rug-pullers. I will one day see toxicity blamed for interfering with honest inquiry, this was not that day.

Tether Heating Up

With increasing talk of regulation coming to the crypto markets in general and stablecoins in particular, Tether seems to be firmly in the crosshairs

Tether is like the main killer in a slasher movie. Every time you think you’ve dealt with it, it pops back up. Where do we stand?

It’s hard to summarize Tether. It’s supposed to be a fully backed stable-coin (with one dollar in reserves for every Tether issued). The question of whether or not they are fully reserved has been definitively settled: They are not, not by a long shot.

Just how solid their reserves are remains the subject of speculation as the reserve information they disclosed was rather opaque.

This leaves us with the question of how serious of a problem this is.

Opinions here range from “not serious at all” to “they will bring down the entire market”. My personal suspicion is that the truth is somewhere in the middle.

I’ll leave some interesting threads below, my current perception of Tether is:

It’s trying to be “The Fed” of Crypto with all the good and bad that entails

It’s withstood pretty savage swings without breaking so far

Regulators will come after it with gusto

Fully-backed competitors are on the horizon, but their buttoned-down nature may not allow them to serve some of Tether’s key markets.

A good part of the Tether risk has been assimilated into current prices. No sophisticated participant today will be able to claim to be surprised that Tether was not fully-backed.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Cantillionaires

It’s good to be close to the money printer.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Price holding its range despite the Chinese ban and regulatory FUD. Stack patiently

Dip Fishing

No news here, smart money still accumulating. Weak hands capitulating

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.24 - Inverted

A Billion Reasons || Tale of Two Banks || BBVBTC || China Fumbles || Goldman Enters Chat || Ironic || Bass Ackwards || Repo Man || More Weird Noises

TLDR:

The world according to Bitcoin seems upside down right now. The case for Bitcoin has never looked stronger but you wouldn’t know it from looking at the price or the behavior of some players.

THE STANCE

My personal opinion on where the ball might be heading.

If you’ve learned everything you know about Bitcoin from the mainstream media, you may think Bitcoin is mined by boiling polar bears in China.

The reality is less grim and a lot more nuanced.

By encouraging Bitcoin miners to leave, the Chinese government may have made the decisive geopolitical blunder of the century.

If Bitcoin doesn’t fail, it will become a new source of power analogous to having abundant natural resources, a powerful military or intellectual capital.

To voluntary relinquish the global lead in mining seems a colossal mistake for them and a huge win for Bitcoin. The resiliency of the network will increase as mining becomes more distributed and one of the preferred sources of Bitcoin FUD (China mining bad) will be gone.

Energy usage is a complex topic and if you are concerned about Bitcoin’s energy footprint, there’s a lot of material that you can wade through including this excellent article: Bitcoin Mining and the Case for More Energy.

TLDR: Channeling energy is synonymous with human flourishing and Bitcoin —through the introduction of new economic dynamics into the production and consumption of energy— may trigger a new era of prosperity.

Why?

While no one knows for sure, the purported reasons seems to be a combination of tamping down on corruption and a desire to impose their surveillance coin CBDC on the Chinese population, but it seems uncanny that they would be so short sighted. Other motives may well be lurking beneath the surface, we will have to wait and watch to find out.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

A Billion Reasons

On the heels of announcing it would buy an additional $500M in Bitcoin through the emission of a bond, Microstrategy decided to give itself the option of issuing up to a Billion dollars’ worth of new shares in the future.

@Macroscope offers an interesting perspective on what this could mean:

Tale of Two Banks

Two supranational banks had very different reaction to El Salvador’s plans to incorporate Bitcoin as legal tender

BCIE Plays Ball

The Banco Centroamericano de Integración Económica —whose charter is to promote the economic development and integration of its fifteen members— signaled its support for El Salvdor’s decision to adopt Bitcoin

World Bank Clutches Pearls

The World Bank —an ill-functioning and opaque organism suspected of being complicit in all manner of global problems— claims they are too holy for Bitcoin.

It seems the joke may be on the World Bank however, as their charter may mandate them to comply with the request.

BBVBTC

In another bit of mixed news, BBVA is starting to roll out Bitcoin for some private banking clients in Switzerland. This is, in general terms, positive news but as Caitlin Long hints at below, traditional banks are used to working with fractional reserves and rehypothecation (loaning out more than they hold in reserve).

One hopes they are clear that it would be suicidal to do this with Bitcoin, if they are not, things could get ugly for them.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

China Fumbles

Without a doubt, one biggest news items this week was the exodus of Bitcoin miners out of China after the government vowed to impose much stricter regulations on several aspects of the cryptocurrency.

While these actions may prove a minor inconvenience (slower blocks, higher fees) over the next few weeks, this is such a gift for Bitcoin in the long term that it’s hard to comprehend

Goldman Enters Chat

Goldman has once again changed its mind on Bitcoin and decided that it is an asset class after all and will begin trading Bitcoin futures (Galaxy Digital to provide liquidity).

Apparently two commonly held belief are :

Where Goldman goes, the rest of the financial markets follow

Goldman entering an asset class is rarely good news for the asset

So, we’ll have to wait to see where this one lands.

Ironic

This one was just too apt not to share

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Bass Ackwards

Seems Jamie Dimon has a sense of humor, and the punchline is that people actually listen to him.

If you are new to the concept of inflation, the central point is this:

Your money is worth less as time passes.

In an inflationary scenario you want to trade your cash for assets —which usually appreciate in price— because your cash will be worth-less tomorrow. So Jamie is basically telling you something like: “you should buy fidget spinners because they’re going out of style”.

It. makes. no. sense.

Repo Man

The repo markets are acting up again (they started in 2019)

Look, I’m not going to try to explain the Repo markets here. And I’m definitely not going to try to explain the reverse repo markets (if you are very curious this article describes the situation a little).

What you need to know is that this is part of the financial plumbing and it’s making weird noises. We all know that when plumbing is working it is invisible and out of sight. It doesn’t take a rocket scientist to imagine what’s about to shoot out from the wrong end of a pipe if something goes wrong.

More Weird Noises

Rating agency Fitch says all is well in Canada.

The markets beg to differ.

Greg Foss should be on your radar. Doubly so if you are learning about Bitcoin. He does a great job explaining how the bond markets and Credit Default Swaps (CDS’) in particular can give us a new perspective on the state of the economy. TLDR: The “risk free rate” is not risk free and if sovereigns start defaulting —which they can and do— the potential domino effect would be huge. Bitcoin is the best insurance against this scenario.

happy?

It seems Bloomberg is beating the WEF drum trying to sell you on serfdom.

To the extent you’d rather pass on serfdom, you should be stacking sats.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Price was swimming for the surface but got pulled down again last week. The board is now slightly below the surface of the water. We’ll see if price manages to hop back on.

Dip Fishing

The dip fishing chart shows nothing new. We’ve been trawling the “Surprising” levels for over a month:

Could we go under $30k? Sure, the next “hard stop” is at $14.5k

Do I think that’s going to happen? I really don’t but I could be wrong.

Should I wait for a bigger dip to get fully allocated? I wouldn’t.

But what about the “Death Cross”? Previous history clearly indicates price will go up, down or sideways after the cross (if you’ve never heard about the “Death Cross” keep it that way).

Who?

So WHY is the price not rising?

I don’t know and (really) neither does anyone else.

The tweet below, however offers an interesting perspective though. It turns out You can buy Bitcoin “at a discount” right now by buying shares of Bitcoin’s Grayscale trust.

I won’t dive into the details of Grayscale (it’s like a buying a complicated Bitcoin IOU) but the point is that Grayscale owns a ton of Bitcoin, they are one of the few vehicle available for some institutions, and they are currently selling BTC at discount for reasons beyond the scope.

Don’t Chase Price

It seems we will be hanging below $60k for a while, you know what would be a great thing to do while we are here?

Stack Hard, Study harder

If you study Bitcoin hard, you may get to switch from thinking in fiat to thinking in Bitcoin.

Instead of measuring your wealth by calculating the fiat value of your holdings you measure it by how much you own of the new monetary network.

More sats = wealthier, price just takes time to catch up sometimes.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.23 - Money

Wat Mean || Volcano Money || Locked Taproot || Fiebre de Bitcoin || Nigerian Princes || Tonga Enters Chat || India Nods || Based Union || Texas: Custodian Banks || Oversubscribed || Warren About Bitcoin || BTC VS IMF || Dutch Ban? || China Ban || Binance On The Spot || Wily WEF || Inside Pennsylvania || Surely Temporary

TLDR:

Insane week:

- El Salvador adopted Bitcoin as legal tender

- Taproot was activated.

Bitcoin just acquired new powers while crashing to a new level in the Geopolitical stage, buckle up.

Salvadoreñ@s, platiquemos de Bitcoin!

THE STANCE

My personal opinion on where the ball might be heading.

Bitcoin Is Now Money

Whatever else can be said of him, El Salvador’s president Nayib Bukele proved to be a man of action. He managed to go from announcement to fact in less than a week:

Bitcoin is now an official currency in El Salvador.

Bukele’s amazing speed of implementation suggests he knew that he would either pass this quickly or not at all and, predictably, the IMF immediately made concerned noises

The stage of “Nations adopting and holding Bitcoin” has officially begun, much sooner than most of us expected. Bitcoin has left the harbor and is has entered the open seas. Recent price action has been a taste of the level of conviction it takes to withstand Bitcoin’s G-forces. If you are still here, welcome aboard mate.

There be dragons here for sure, but there’s no place else I’d rather be. And if Taproot’s activation showed anything it’s that while we may bicker, spar and even make our heroes walk the plank every now and then (let’s hope Breedlove doesn’t join that list), we keep moving forward, arms locked and laser eyed.

Nowhere is it written that we will win this battle but this is a battle worth fighting if we are to leave this place better than we found it.

PS. I’ve been called upon to do my part and I’ll be honored to add my grain of sand. Huge gratitude to Miles Suter for the invitation.

Herman@s de El Salvador

Bitcoin no es fácil de entender al principio pero con cinco conversaciones van entender las bases y con un poco de trabajo y paciencia les va a quedar clarísimo. Estoy a sus órdenes.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Wat Mean?

If you are curious about the impact and implications of El Salvador’s adoption of Bitcoin as money, this well written article is well worth 16 minutes:

Volcano Money

By happenstance, the historic vote that made Bitcoin currency in El Salvador was covered live by wunderkind and fan-favorite Nic Carter. What sterted as a Twitterspace to stave off boredom while cooking dinner quickly became a who’s-who in Bitcoin and culminated with president Bukele and his brother chatting live with the Bitcoiners as the bill was debated and passed. Bitcoin aside, it was a low-key ground breaking moment in media coverage.

During their unscripted conversation the question of mining came up and Bukele replied that he had not given much thought to it, but noted they have a lot of geothermal energy from volcanoes, giving instantaneous birth to the wonderful idea of VOLCANO MINING

Not only does Volcano mining make for some awesome memes I’ve ever seen in Bitcoin, it will deal a strong blow to energy FUDsters who have been coming at Bitcoin from all sides lately.

Locking Taproot

It won’t activate until November, but Taproot is now almost a done deal. The majority of miners have signaled that they are ready, willing and able to mine Taproot transactions starting November. They need to keep their word and we —the people who run full Bitcoin nodes— need to upgrade our version of the Bitcoin software so that our nodes will recognize these transactions and blocks as valid.

If you are running a Bitcoin node please upgrade it right away.

The upgrade is quite a big deal from a couple of different perspectives:

The functionality that it will enable will expand Bitcoin’s use cases significantly and give birth to Bitcoin-based DeFi and better privacy

The upgrade “lock-in” process itself went smoothly, and happened relatively quicky without significant contention —this in sharp contrast to the previous (USAF) soft fork.

Both of the above send a clear signal that Bitcoin —despite the slower pace of change— has a vibrant development, an engaged user base and mostly supportive miners, all of which are able to work together to execute effective governance.

Ben Carman gives a good summary in the article below:

Fiebre de Bitcoin

Several politicians of various rankings in Latin America eagerly jumped on the train of demonstrating support for Bitcoin. It’s far to early to tell if they have any real conviction about it but it was encouraging to see.

No solo Latin America…

Nigerian Princes

In some ways, Nigeria’s case is the antithesis of El Salvador. A few months ago, the government of Nigeria decided to ban Bitcoin. The youth of the country decided to use it anyway and built a parallel financial system using Bitcoin, resisting the governments vigorous attempt to stop them, at significant personal risk. Remittances were a visible example of their success.

NFL player turned Bitcoin advocate Russel O’Kung (of Nigerian descent) penned a powerful letter to the president, encouraging him to take decisive action around adopting a Bitcoin Standard

All that is required is a vision for a new future and an allocation of its own national resources to pursue a Bitcoin standard.

—Russel O’Kung

The youth of Nigeria has adopted Bitcoin as their currency, let’s hope their government respects their decision.

Tonga Enters The Chat

As all of this was going down, Lord Fusitua of Tonga started engaging prominent Bitcoiners and it seems they have genuine interest in moving forward

Just like Michael Saylor’s Microstrategy, Our country Tonga is also sitting on a $700 million melting ice cube and #Bitcoin fixes this.

— Lord Fusitua

It’s hard to overstate how big it would be if a second nation were to adopt Bitcoin quickly, especially if that nation were not hostile towards the USA.

Once El Salvador’s move becomes a movement, the momentum will be hard to stop.

India Nods

It seems the recent India FUD might have been overblown after all…

Based Union

A recent proposal for a 3-year ban on Bitcoin mining in the state of NY was shut down by the International Brotherhood of Electrical Workers

Texas: Custodian Banks

The Texas Department of Banking has determined that its affiliate banks may now offer Bitcoin custody services to their customers.

Oversubscribed

Microstrategy planned to raise an additional $400M to buy more Bitcoin, after getting bids for $1.6 Billion, they settled on $500M

They should start buying early this week. If we go by past experience, the price of Bitcoin should not be significantly affected by these purchases, but I’d still front-run them if I could.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Warren About Bitcoin

One of the latest videos to make the rounds was this awfully misleading piece by Elizabeth Warren in which she misrepresents the reality of Bitcoin’s energy consumption while praising the privacy-killing, chinese-inspired CBDCs (Central Bank Digital Currencies)

And if you’re not yet up to speed on the reality of Bitcoin’s energy usage, there’s a lot of great material out there and here’s a chart for you to consider:

BTC VS IMF

Seems the IMF was not amused by El Salvador’s mad dash at monetary freedom and said it created “risks”. Max Keiser put forth a proposal to create “Volcano Bonds” which would allow Bitcoiners to support El Salvador if the IMF threatens them. This is going to get very interesting…

Dutch Ban?

A high-level Dutch bureaucrat dislikes crypto and —making the common, beginner mistake of conflating Bitcoin with “crypto”— proposed an ill-informed total ban on all cryptoassets. I suspect this will be a nothingburger.

China Ban

It’s kind of finally happening. China is not banning mining outright, but some regions have and others are imposing strict guidelines with compliance inspections coming by the end of this month.

Hashrate Drop

All of this is causing many miners to migrate out of the region, the impact on hashrate was visible, dropping aprox 20%

The crackdown on miners in China is a stress test for Bitcoin that will ultimately yield sweet fruits. Mining will become more geographically dispersed which is good. Miners will be moving out of a region where coal-generated power is cheap because of subsidies. I fully expect Bitcoin to come out of this stronger.

Binance On The Spot

This past month has been rough for Binance, one of the world’s largest crypto exhanges. This may be a taste of what’s to come with the new US crypto regulations.

One of its Indian subsidiaries is also in the crosshairs:

If you have any coins on Binance (or any exchange really) this would be a good time to move the to your own wallet. Why expose yourself to counterparty risk?

Wily WEF

I was initially flabbergasted. Out of all possible entities, the WEF —of Great Reset infamy— published a glowing article on cryptocurrencies.

I thought I was taking crazy pills, until the other shoe dropped. Of course they weren’t talking about Bitcoin, rather they wanted to direct your attention to these other fascinating projects…

Here’s a hot tip for you, if the same organization that is pushing the slogan “You’ll own nothing and you’ll be happy” recommends a shitcoin, altcoin maybe don’t buy it.

Inside Pennsylvania

Bitcoin is in the Whitehouse. It was revealed that at least one of Biden’s top advisor is a Bitcoin Hodler.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Surely Temporary

US inflation numbers came out lower than what most americans experienced but higher than talking heads expected

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Swimming Towards Air

Price seems to be slowly making its way to the surface. With all the bullish news it should get back on the board again soon.

But these are not normal times.

Lockdowns are coming to an end, summer is now ON and people are away from their keyboards and rediscovering other humans. So who knows how long this sideways action may last.

But I’ll make one forecast: These are the days you’ll look back at ten years from now, and whisper to yourself “I should have bought more”.

Dip Fishing

I don’t want to jinx it, but it seems we’ve trawled the bottom on this one. Whatever your “full allocation” plan is for Bitcoin, it should be in place by now.

Another good one from BTC Charts (PS. means HODL or BUY)

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.22 - Inflection

|| Next Level || Young King || Solar Test ||Dorsey Doubles Down || True DeFi || Schnorr Tapping || Beyond Redemption || Russia Out

TLDR:

The price chart doesn’t show it yet

The news hardly mentions it yet

It’s not really visible yet

But Bitcoin’s next chapter started June 5th, 2021

THE STANCE

My personal opinion on where Bitcoin seems to be heading.

Next Level

On June 5th 2021, Nayib Bukele, President of El Salvador — the first head of state ever to speak at a Bitcoin conference— declared he would push a bill to make Bitcoin legal tender in his country.

I have not yet cultivated a personal opinion on Bukele or El Salvador, I’ve read good and bad things, which seems par for the course. But this is not about him.

A country —even a small one— attempting to make Bitcoin legal tender pushes Bitcoin into the next dimension of geopolitics. It just does.

Bukele’s proposal still needs to be approved but those closer to the ground think he has a good chance of pulling it off as far as local opposition is concerned.

However —as Caitlin Long describes in a solid thread below— his opposition is unlikely to remain local for long. You see, if Bitcoin becomes a country’s currency it could be redefined as money under US Commercial Law, which would endow it with different legal status and accounting requirements than it currently has.

It seems Bukele is aware of the potential pushback and decided to go for it anyway.

Taking a page from Miami Mayor Francis Suarez’ playbook, Bukele openly courted the community:

Some privileged idiots were prompt to point out that El Salvador is too small to make a material difference to the price of Bitcoin, proving that they missed the point of Bitcoin in its entirety.

Bitcoin’s NGU (“Number Go Up”) Technology is a great meme and a powerful magnet that helps attract new waves of the crypto-curious.

But those that get into bitcoin only for the NGU are the ones selling right now; their lack of conviction makes them unable to weather the volatility.

A few, like Ruffer, are exiting at a handsome profit after meeting their targets. They are traders and have no particular attachment to their positions.

They are not hodlers and take a technician’s perspective to assets.

A lot of selling, however, seem to be coming from relative newcomers who are selling at a loss.

It’s a shame they did not take the time to build up their conviction by understanding what they were getting into.

I’m sure the people of El Salvador will be grateful they can buy cheap sats from these low-conviction speculators.

It would be wonderful to see what sound money does for El Salvador but regardless of what happens, this was the “starting shot” that marked a new stage of the race: Nations openly adopting and accumulating Bitcoin.

Many will ignore it, but a few will be following how this plays out very closely. Hints starting to drop already:

The first countries to realize and act upon the fact that they need to accumulate Bitcoin will gain a decisive advantage over the laggards, like Microstrategy did in the corporate world.

Here is the announcement:

Young King

It’s entirely fair to say that this may not have precipitated now had it not been for the grit, heart and genius of one particular Bitcoiner: Jack Mallers. He is an inspiration and gives me enormous faith in the younger generations.

This moving photo of him embracing his family moments after the announcement warms my heart.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Miami Edition

Over 10,000 Bitcoiners descended on Miami this week, as the world’s biggest Bitcoin event to date kicked off.

Solar Test

Square is investing $5M in an experimental Bitcoin mining facility that will rely exclusively on solar. They will use it as a case study on renewable energy for Bitcoin mining promising to make all its economic information public. Blockstream has partnered with Square to manage the facility

I’ll be interested in the results, although I’m clear that nothing about this will appease the ESG virtue-signalers, the experiment will be a valuable contribution whatever the result turns out to be. I’ll be pleasantly surprised if it turns out to be economically competitive.

Dorsey Doubles Down

Speaking of Square, CEO Jack Dorsey doubled down on his personal commitment to Bitcoin and said Square might build a hardware wallet

“If I were not at Square or Twitter I'd be working on bitcoin. If it needed more help than Square and Twitter, I would leave them for bitcoin. But I think both companies have a role to play.” —Jack Dorsey, CEO Twitter, Square

True DeFi

In this two minute video, Blockstream boardmember Alyse Killeen succinctly explains the problem with DeFi: It’s not really “De” (decentralized)

“A protocol governed by rulers is inherently broken from the start.” — Blockstream Boardmember Alyse Killeen

Take the 2 minutes to watch the clip, I was not aware of Alyse but I’ll definitely be following her more closely from now on.

And speaking of a truly decentralized DeFi:

Schnorr Tapping

It seems the Taproot —the latest upgrade to Bitcoin— is gathering enough support to lock in activation soon.

If you are new to Taproot, I’d summarize it like this:

By allowing different cryptographic math (Schnorr signatures) Taproot will make it much easier to implement smart contracts using Bitcoin.

It has the added advantages of having a very light footprint on the blockchain, a privacy-enhancing architecture and clever, trust-minimizing ways of incorporating “oracles” —sources of information external to the Bitcoin blockchain.

Most of the public is sleeping on Schnorr and the technologies it will enable (like Discreet Log Contracts) because they are not easy to understand, but a few companies like Atomic Finance and Suredbits are on the case.

Bitcoin-based DeFi is coming. You can bank on it.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Beyond Redemption

Not content with spreading Bitcoin FUD and pumping Dogecoin, Elon Musk continued to amuse himself by preying on the unthinking, this time leading them to invest in…Cumrocket. The resulting pump and dump was swift and merciless.

Those clueless enough to let the fate of their savings be dictated by the volatile amusement of man-child Emperor Elon will get thoroughly —and deservedly— REKT.

DYOT —Do Your Own Thinking

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Russia Out

Surprising no one, Russia announced it was exiting its USD positions (currently estimated at USD$41.5B) in its Sovereign Fund.

The announcement was more about posturing ahead of a summit , they’ve been reducing their USD holdings for years amid sanctions and has complained in the past about the “weaponization” of the USD and warned that the policy may have unintended consequences. Some speculate that China —who has also been reducing their USD positions and hoarding Gold— will be next to make the announcement.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

After taking the plunge 3 weeks ago, Bitcoin has been spending most of its time chilling in the $34k to $36k range

Dip Fishing

Revisiting our old Dip Fishing chart reveals nothing new, we’ve been ranging in the “Surprising” range since May 19th.

Each candle on this chart represents one day

It may not look it, but I think this is the moment to “back up the truck”. Most of however much you’ve decided to allocate to Bitcoin should be deployed by now.

Crystal Ball

My power-level does grant me access to a crystal ball yet and Bitcoin has a knack for making fools out of anyone who predicts prices but having said that, I think price-predicting models can be useful for orienting ourselves in terms of price discovery.

Below we have two different models. The “Power Law Corridor” model and “Stock to Flow”

Remember: All models are wrong, some models are useful.

Both models show broad “corridors” that could accommodate Bitcoin’s price being anywhere between $10,000 and $100,000 without breaking.

Some criticize the models for providing ranges so broad as to be meaningless, I disagree.

For me the important takeaway is that current price is well within the boundaries of expected volatility if Bitcoin continues its march upward.

These models will probably break one day, but they have remained valid longer than many would have expected; if you are not prepared to accept the volatility reflected in them as the price of the upward slope you need to reflect on why you are invested in this asset, or better yet, give me a call.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them build the knowledge and conviction to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.21 - Hungover

Indy 500 || MOAR Energy || Apple Enters the Chat || Billionaires Switching Sides || Van Eck ETFs || Saylor Under Fire || Money With Feet || Cryptogenocide || Breaking Taleb || RIP M1 / M2

TLDR:

Bitcoin’s fire-sale is being ignored by men nursing alt-season hangovers. Their lack of conviction will cause many to miss Bitcoin’s next big jump.

Don’t be one of them.

THE STANCE

My personal opinion on where the ball might be heading.

Perspective

Now that alt-season has come to its predictable end I see people who got swept by the mania licking their wounds.

A few were able to take some profits from their alts before the crash, many did not. Some risked more than they should and a few took serious losses.

Looking back, which of the two coins below would you rather have invested in?

As you may have suspected, they’re both actually Bitcoin —the only difference between them is that one shows price in a linear scale and the other in a log scale.

If your mindset is still based on the left chart you’re probably cursing the day you heard of Bitcoin.

If your mindset is based on the right chart you’re probably doing your best to buy the hell out of this pullback.

The case for Bitcoin is crystal clear once you can see it:

It’s obvious that not everyone can see it yet.

Your ability to understand what Bitcoin is, the problems it solves, the severity of said problems, the risks of owning it and particularly the risks of not owning it, will define whether you miss or make the most of the greatest transfer of wealth the world has ever seen.

If money is a topic of interest for you, there is no better investment you could make right now than putting in the work —and make no mistake, it takes work— to wrap your head around Bitcoin

The “formula” for investing in Bitcoin successfully has been neither complex nor secret: Buy and hodl BTC for at least 4 years.

BUT, the catch is that investing in Bitcoin requires serious conviction. You can be certain that there will be times —like these past few weeks— where the strength of your conviction will be put to the test.

This is not unique to Bitcoin by the way, as investing legend Stan Druckenmiller points out:

The second act of this bull market will begin when we least expect it and it’s likely to be spectacular as a participant and heartbreaking as a spectator.

If I were you I’d make sure to size my position to match my conviction and get in. Oh, and I’d stay away from alts this time. But that’s just me.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Indy 500

The Bitcoin car placed 8th in yesterday’s race. A solid beginning to what I hope will be an ongoing story.

MOAR Energy

There has been much discussion around Bitcoin’s energy consumption recently and there is a point that should never be lost: Bitcoin’s energy consumption is amply justified and a good thing.

The tweet above is a great bite-sized summary of why Bitcoin’s energy usage is good and justified, for a more nuanced understanding of the matter I’d point you to this excellent (20 min or so) Medium article

In Bitcoin, we have — for the first time in human history — a technology that directly financially incentivizes the discovery of cheaper ways to harness energy, one which cares not about geographic location, consumer demand, or other historical hindrances to energy generation.

— Bitcoin Mining and the Case for More Energy, Hodl’n Caulfield & Selene Lindstrom

Apple Enters the Chat

Apple incorporating Bitcoin into Apple pay would be a sensible “first date” for Bitcoin and Apple. There have been no announcements yet, but there is reason to believe it’s not just wishful thinking:

Billionaires Switching Sides

Over the past year a stream of legendary investors have started to publicly change their minds about Bitcoin. Some of these “conversions” have been expected for a while and are warmly welcomed

While Dalio has expressed misgivings in the past about governments banning Bitcoin, those who have studied his extensive work on debt have long expected him to eventually come around to Bitcoin. The wait is over.

Others billionaires have been received with less enthusiasm as their hot takes on Bitcoin and/or POW mining and “crypto” in general are, more often than not, uninformed.

One of the golden rules in Bitcoin is, if you’re going to complain about some aspect of Bitcoin, do your homework before. Those who don’t quickly find themselves on the receiving end of a swarm of cyber hornets.

Van Eck ETFs

It seems Van Eck will be going live this week with it’s Europe-based Bitcoin and Ethereum ETFs. Should be huge.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Saylor Under Fire

Michael Saylor brokered a meeting between some miners and Elon Musk and —not entirely without reason— Bitcoin Twitter lost its collective mind.

Let me make my position clear: Any incarnation of a “Ministry of Mining” would be bad.

Not because transparency of information around energy consumption is bad, but rather because it could put Bitcoin on a slippery slope that needlessly threatens its fungibility and censorship resistance “we only accept Green Bitcoins here”.

This would posit a threat to Bitcoin’s independence on par with regulatory capture and should be firmly, emphatically and vocally opposed.

I have no problem believing that Saylor was just trying to get ahead of the narrative in good faith. His advocacy has been tireless and his understanding of the nuances of Bitcoin is beyond dispute.

I’d much rather have a financial and intellectual heavyweight like Saylor act as diplomatic matador in the bullring of ESG virtue-signalers than having a mob of angry plebs screaming in cacophony.

Still, we must remain alert. Hostile interests will continue to try to capture Bitcoin and it’s up to each of us to not permit this to happen.

Money With Feet

Jurisdictional arbitrage is going to be huge in Bitcoin. We already see the different battle lines being drawn as different states adopt postures around Bitcoin, attracting or repelling investments in the process.

Having said that, you can be certain about one thing. Federal regulation IS coming to Bitcoin:

I hope that the current cohort of Bitcoin-savvy regulators will produce regulation that fuels rather than hinders Bitcoin’s progress.

Cryptogenocide

This as perhaps the funniest thing I saw all week.

Pack it up guys, it turns out Bitcoin is a weapon of mass destruction.

Breaking Taleb

After a rather public fallout with prominent Bitcoiner Saifedean Ammous, Taleb has been showing frequent episodes of fragility, culminating in the announcement that he’ll be a speaker at a Bitcoin SV conference. There’s no coming back from this.

If you are lucky enough to not know what Bitcoin SV is, I’ll summarize by saying it’s one of the worst forks of Bitcoin and is backed by Craig Wright aka “Faketoshi” a lawsuit-happy clown who is financially backed by a gambling magnate and apparent low-life Calvin Ayre.

The fact that Taleb is willing to share a stage with these people speaks to a monumental lack of judgement.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

RIP M1 / M2

The FED will no longer update their M1 and M2 charts. I wonder why? Perhaps we should have one last look at those charts:

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Underwater

Bitcoin is still trying to come up for air. We’ll see how long it takes it to find its way to the surface.

We’ve been in “surprising” territory for over two weeks now. I hope you’ve been making the most of it.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.20 - Fear

Is This it? || Digging Ross || Racing Bitcoin || China Ban Bitcoin || Exiting DeFi || CBDC Dreams || Splash || Liquidation Cascades || Buy, Sell or HODL?

TLDR:

Afraid? Study harder.

However long it lasts, however low it goes, you will look back at this dip in the knowledge that it was the best investment opportunity of your lifetime.

Will you be smiling?

THE STANCE

My personal opinion on where the ball might be heading.

A more immediate and ominous sign of an approaching tsunami is a rapid and unexpected recession of water levels below the expected low tide.

—Early warning signs of a tsunami from the Government of Canada’s “Get Prepared” website.

Is this it?

As the price of bitcoin kept dropping many wondered how low it could go. Just how bad was this pullback, historically?

Frequently heard questions included:

Will price keep dropping? How low could it go? Is alt-season over? What game is Elon playing?

None of this matters.

This past few weeks have seen massive, seemingly coordinated Bitcoin FUD:

In the past, these type of FUD-fests have been precursors to someone(s) taking a LARGE position and eventually resulted in Bitcoin resuming its climb.

I don’t see any real negative developments which should cause you to change your investment thesis for bitcoin.

Lets travel a few years into the future and see if we can paint a picture:

Bitcoin is legal tender virtually everywhere (most central banks hold it as part of their reserves), financial institutions have long integrated it into their services and you have a wide variety of options for interacting with it —depending on your convenience/security and risk/reward preferences. THE most popular loyalty program (offered by all credit cards) is “sats back”. Almost everyone talks about sats —which are used every day. Bitcoin is only mentioned when very large transactions occur.

Money transmission fees have gone the way of long-distance fees, the vast majority of global money transmissions happen over the bitcoin network and are virtually instantaneous and free.

A good portion of your insurance and pension are backed by bitcoin and all large corporations and high-net worth individuals hold a portion of their reserves in bitcoin.

Most internet purchases are paid with Bitcoin, some apps automate the process of replenishing your sats from your fiat accounts after each purchase.

Absorbing most of gold’s monetary premium turned out to be just the beginning for Bitcoin. The real wave came with the great bond unraveling (it was not pretty).

Everyone said it was obvious in hindsight.

But not everyone had the discipline to stack nor the conviction to hodl through the volcanic, price-discovery roller coaster that came from the separation of money and state.

How high did the price go, you ask?

Let’s just say bitcoin added several zeros before this stopped being a relevant question.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Digging Ross

Ross Stevens —the man that billionaires, insurance companies, banks and central banks call when they start to take Bitcoin seriously— sat down for an interview. And it was beautiful.

Racing Bitcoin

I don’t usually follow car racing, but I’ll be watching the Indy 500 with interest this year. When I first heard about the Bitcoin car in passing I thought it was someone’s fun marketing experiment.

Then I heard Ross Stevens pal about it in the interview posted above and read about how the project came together.

I’ve now made my donation and will be rooting for car 21, I feel privileged to contribution, even if modestly to this great project.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

China Ban Bitcoin

It seems that China is banning Bitcoin mining and trading for the umpteenth time…

Some reputable sources say there may be some reality to it this time, but you should be aware that the “China Ban” has become a time-honored tradition in a bitcoin bull-market

Is this bad for Bitcoin?

I don’t think so, certainly not if you are outside of China and have a long-term perspective. Bitcoin’s links with China have long been a rich source of FUD. Nic Carter lists some of the positives that could come from such a ban:

Exiting DeFi

News broke that DeFi 100 had pulled an exit scam —running away with all their investors’ money— and had posted as much on their website:

They later claimed their site had been hacked. Still not sure what the reality of it was and one of the many advantages of focusing on Bitcoin only is that I don’t need to care about DeFi100 and thousands of other “cryptos”.

Among others, they all DeFi (Decentralized Finance) tokens share a fatal flaw: they’re not actually decentralized.

Bitcoiner Mantra:

Play stupid games, win stupid prizes.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

CBDC Dreams

They Fed is seriously considering issuing a memo about commissioning a study about thinking about considering Central Bank Digital Currencies (CBDCs).

I am in NO rush to see CBDCs happen, and you shouldn’t be either. They’ll simply be surveillance enhanced digital fiat, the worst of all worlds. Let them take their time.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Splash

Bitcoin’s price took a dive, falling off the board and plunging straight into the water:

There’s a lot of water before we hit the sand, I personally don’t think we will go under $30k, but the chart shows the next big support level around $14k.

Corrections like this one are not unheard of:

Looking back at the same chart I’ve been posting for over a month now, we can see that (while definitely surprising) this pullback has not been entirely outside of the expected boundaries —with the exception of a few aggressive wicks (probably the result of liquidation cascades).

Liquidation Cascades

If you want to take a peek “under the hood” and see what a liquidation cascade looks like from a trader’s perspective, you’ll enjoy the thread below. You may not understand all of it if you’re not a trader, but I recommend you read it anyway to get a sense of how real, hard-core traders think about things:

Buy, Sell or Hodl?

I obviously don’t know how deep this correction will go, nor how long it will last. But I do know this:

You should not stress too much about “catching the bottom”.

In terms of risk/reward, you probably won’t have a better opportunity to establish a strong Bitcoin position.

To the extent that your conviction allows you to set aside money for the next four years or so, go forth and stack hard.

If you already have a Bitcoin position and don’t have more fiat to put into it just be patient. Regardless of whether your position is in profit or not right now, just hodl tight. We have not seen the top of this cycle yet.

If you are still hesitant about investing in Bitcoin, you should book a call with me ASAP.

Strong hands are best built TOGETHER.

In just a few conversations I can help you develop the knowledge and confidence to invest in Bitcoin safely.

Schedule a call with me to see if there’s a good fit.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.19 -Drama

Elongated || Bitcoingram || Fundamentals || Joining the Club? || Tether Woes || Surprised? || The Setting Sun || Falling off the Board

TLDR:

Fuck Elon. We have bigger fish to fry. Oh, and fuck Tether too.

THE STANCE

My personal opinion on where the ball might be heading.

The difference between a trader and a truly prescient investor is having the courage to let your winners run until you reach the logical conclusion of the investing thesis that prompted the initial investment. That requires not just tactical trading acumen, but a macro belief in a theme or regime that powers the asset’s long-term returns.

—Arthur Hayes, Grow Up or Blow Up

Elongated

I’m not sure what prompted Elon to get into Bitcoin in the first place but his brief affair started skidding on Wednesday, hit the wall hard and by Sunday had turned into a blazing fireball that would have put a malfunctioning Tesla to shame.

There’s no coming back from this one for Elon.

The first important thing to understand is not just that Elon’s take is wrong but that he knows it’s BS.

Like Andrew Tate points out, it would be ridiculous for Elon —as an electric car maker— to say “electricity for car good, electricity for money bad”

This was obviously not a concern when he prompted Tesla to invest $1B and since the “miners boiling the oceans” FUD has been around forever. There’s no way he /his team didn’t look closely at the claims while their due diligence for Tesla’s investment —it’s worth noting that he clarified Tesla was not selling their Bitcoin.

If he had really been concerned about Bitcoin’s energy usage, wouldn’t he have asked Michael Saylor?

Here’s an 8-min video with what Saylor would have responded:

The second important thing to consider is that Tesla relies heavily on government subsidies to stay afloat, and recently signaled an interest in entering the renewable credit market:

The third thing to understand is that this could have been a calculated move to make Bitcoin’s price dump before its next leg up.

The final straw came when Elon tweeted that he was working with Dogecoin developers (lol, there’s basically no such thing) and then posted a completely asinine take on how Dogecoin could become a real green, more efficient alternative to Bitcoin

His proposal is akin to saying that his rockets should be propelled by cow farts solving climate change and transportation to Mars in one go, and by the way, he’s working with his cousin on a great idea for bottling up cow farts.

It would be a cute take from a 10-year old but it betrays either malfeasance or blatant ignorance about the tradeoffs involved in a blockchain. Regardless of what his true intentions were, the effects were noticeable:

Needless to say, Bitcoiners were not pleased. Even Doge’s creator (Palmer Lucky) who has been largely absent from Twitter reemerged briefly to make it known he was not on board:

All of this was already bad. But it did not end there.

Peter McCormack wrote a solid thread calling Elon out with well though-out arguments, his response was that of a churlish child.

Around the same time Michael Saylor also tweeted at Elon cordially, inviting him to reconsider his position, but the “Technoking Imperator” responded with an attempt to demean Saylor.

We have wasted enough time on this: Fuck Elon.

Jack Mallers —the brilliant young man who is using Lightning to reshape the global financial landscape as we speak— chastised Elon in a phenomenal thread:

It’ll be interesting to see if Elon starts putting his billions to work pumping Doge or chooses to leave behind a destitute army of followers once he absconds to Mars.

In the meantime, Bitcoin is on sale and I suspect that it’s partly due to this week’s Tether news, read below in the CRYPTO WARS section.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Bitcoingram

MoneyGram is partnering up with Coins to offer its customers Bitcoin ATMs at some locations. An interesting start.

Fundamentals

Despite the bearish news this week, Bitcoin’s fundamental proposition remains unchanged and the clear signs of inflation only underscore the importance of having insurance against out-of-control monetary policies.

They say “be greedy when others are fearful.”

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Joining the Club?

There’s always a stir when someone famous first jumps (or seems to jump) into Bitcoin. Often these stories have disappointing endings.

This week we saw two":

Facebook’s Mark Zuckerberg announced he had two goats named Bitcoin and Maxi respectively.

A lot of people tweeted excitedly about how Zuck would soon reveal a massive BTC position.

Me? I have an open $20 bet that he’s going to slaughter those goats himself (as he does) and feed them to some Bitcoiner acquaintance.

There was also Tom Brady going Laser Eyes™, but then he may also be doing an NFT thing? Happens all the time.

Tether Woes

I’d like to thank Alexander Cortes for bringing this to my attention. I’d glanced through Tether’s report and dismissed it, thinking mistakenly that Tether FUD had been buried for this cycle. I was wrong.

If you are already aware of Tether, skip ahead to “The Problem”

For those of you who tuned in after Bitcoin breached $20k, here’s a quick summary:

Tether is the largest “stablecoin” —a cryptocurrency that tries to retain a stable exchange rate, in this case 1 Tether = 1 USD.

There are multiple reasons why stablecoins are useful, speed and low regulatory friction being two important ones. Stablecoins allow traders to move virtual-USD between exchanges quickly even if those exchanges can’t accept USD directly (because they don’t meet the necessary regulatory requirements).

Tether also became a practical tool for people who wanted to skirt various regulations in different countries. So there’s always been an air of opacity and shadiness around Tether.

Theoretically, Tether’s promise was that they would always have full backing —which means $1USD in the bank for every Tether printed.

Early on, this promise came into question. Skeptics rightfully pointed out that there was no way to verify wether Tether’s “fully backed” claim was true and there was at least one instance in which it became clear that Tether was not fully backed.

Eventually Tether and its parent company Bitfinex came under investigation by the NY Attorney General over allegations that they’d tried to cover up $850 million in losses.

“These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

— New York Attorney General Letitia James

The two-year investigation was settled in February of this year with Tether admitting no wrongdoing and agreeing to an $18.5 million payment and to issuing quarterly transparency reports.

The Problem

Is Tether being created out of the blue to pump the price of Bitcoin?

If Tether is not backed 100% by cash, what is it backed by?

The first of these questions became a furious debate back in 2020, before Bitcoin breached $20k and Michael Saylor started his campaign to drive institutional adoption. The short answer appears to be a rather definitive NO, Tether is not created out of thin air to pump Bitcoin. A lot has been written about this, Dan Held offers a good summary in his piece: Don’t Fear Tether.

The second question gets more interesting. Unfortunately, the short answer is No, Tether is NOT fully backed by cash.

Tether released their first Reserve Breakdown and —beyond the Elon drama— it could be a big part of why Bitcoin has been dumping these past few days:

In their amateurish, 2-pie-chart report, Tether offers a “Cash & Cash Equivalents” category, representing 75% of their reserves. Which means Tether is 75% backed at best. Drilling down we find that actual cash is less than 3% of reserves with another 2.2% from the T-bills portion. If you are feeling generous you can also add the 10% from “Corporate Bonds, Funds and Precious Metals” to conclude that Tether’s backing consists of 15% “real money” and 75% is backed by “sumthin sumthin”. Nocoiners rejoiced at the news:

Tether’s situation is doubly unfortunate because it could have been easily avoided if discipline had been able to supersede greed.

Caitlin Long (an industry treasure) explains why it’s both inappropriate and stupid for Tether to have introduced credit risk into the reserves that were supposed to back its peg. And she drives home the point that —not only does the market already have access to other stablecoins than Tether— thanks to Wyoming’s forward-looking legislators, the market will soon have access to stablecoins issued within a legal framework that will make it impossible for them to be anything other than 100% backed.

Greg Foss —who should be in your radar given his broad experience and insight in the bond markets— responded thoughtfully to Caitlin’s thread.

I interpret his thoughts thusly:

Tether risk is tied to fiat risk, your bank is probably in worse shape than Tether. If credit risk starts to spread (contagion) with corporations defaulting and causing others to default, your only insurance option will be Bitcoin. So some of the very conditions that could drive Tether to fail would drive Bitcoin to thrive.

In conclusion: Tether remains a shady operation operating cowboy style and is best avoided, it’s likely the current dump is due in part to the market discounting Tether risk, but Tether does not represent an existential threat to Bitcoin. Anyone using Tether today is cognizant that it comes with risks.

There are already other stablecoins that are less risky than Tether and the number and quality of competitors will only improve with time.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Surprised?

The Fed was surprised by high inflation numbers.

Really? Maybe it’s just me, but it seems they should get out more.

The Setting Sun

It’s no secret that the USD’s tenure as the world’s reserve currency is not guaranteed to be permanent. Indeed the increasing cracks in its foundation are increasingly visible. Here’s Druckenmiller’s take on it:

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Falling off the Board

Bitcoin fell off the board, this week will be about seeing it struggle to get back on or possibly fall further.

Dip Fishing

I thought I’d already retire my “Dip Fishing” chart from a month ago, but it’s still proving useful, I added the 200 day Moving Average (rising blue wave). Previous bull runs have had several “touches” of the 200MA, we've yet to see one this cycle.

People often complain that “Bitcoin is too expensive” and say they would buy if it were cheaper.

This is that moment. Bitcoin is on sale right now.

Are you loading up?

Each candle in the chart represents one day.

Never invest in something you don’t understand.

I help individuals, families and corporations understand the WHY and HOW of investing in Bitcoin.

Schedule a free 30-minute call with me if you’d like to find out more.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.18 - The Prestige

For Keeps || Curiouser and Curioser || Missed the Barn || Russia Shopping for Money || Woe Is Me || Govcoin || Accumulation

TLDR:

If “Crypto” is a magic trick, we’re getting ready for “The Prestige.”

Are you being misdirected by greed?

THE STANCE

My personal opinion on where the ball might be heading.

Act Three is coming

Every great magic trick consists of three parts or acts. The first part is called “The Pledge”. The magician shows you something ordinary: a deck of cards, a bird or a man. He shows you this object. Perhaps he asks you to inspect it to see if it is indeed real, unaltered, normal. But of course… it probably isn’t. The second act is called “The Turn”. The magician takes the ordinary something and makes it do something extraordinary. Now you’re looking for the secret… but you won’t find it, because of course you’re not really looking. You don’t really want to know. You want to be fooled. But you wouldn’t clap yet. Because making something disappear isn’t enough; you have to bring it back. That’s why every magic trick has a third act, the hardest part, the part we call “The Prestige”.

― Christopher Priest, The Prestige

Spoiler alert: I’m about to reveal how this movie ends.

The Pledge: You are shown a collection of ordinary shitcoins. they are worthless digital tokens that for years have failed to live up to their promise (if any).

The Turn: Scammers Savvy “crypto-investors” drive the price of these shitcoins up to THE MOON by pumping some money into them —the more worthless the coin, the more the price goes up because of their shallow markets. Everyone jumps excitedly into the shitcoin casino with both feet, dazzled by the astonishing wealth they are accumulating on-screen. Eye-popping returns for absolutely no reason, crypto is AMAZING!

I MEAN, LOOK AT THESE RETURNS!! (WHY AM I SCREAMING?):

The Prestige: The mercenaries savvy traders dump their shitcoins which crashes their price) taking your money and plowing it back back into Bitcoin.

Not only does this pump Bitcoin’s price and leave you holding a bag with heavy losses. To add insult to injury, it also makes you miss out on one of Bitcoin’s legendary moves, all because you invested in some dodgy coin “because it was going up a lot”:

What’s that?

It won’t happen to you because you’re going to sell on time and be part of the few who get to ride the alt-coin wave AND the Bitcoin wave?

You say you’re a well-connected, elite trader with daily insider-info?

Cool story bro.

You had the chance to buy the best asset in history at a rate of 1,700 sats for a single US dollar but decided to buy shitcoins instead. Well, maybe your grandkids will find the memes funny one day. Or, you know, not.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

For Keeps

The boys at NYDIG are not playing around. They are aiming to become part of the backbone that will connect legacy finance to Bitcoin, which sounds lofty and nice. But they are executing fiercely.

NYDIG is positioning itself as a one-stop-shop where the Banks, Insurance Companies, Corporations and High Net Worth Individuals can go for all things Bitcoin, and they are killing it.

In fact this is so bullish, that this will be the only piece of news in this section this week. No shitcoin has a single company doing this caliber of work, So stop scrolling, go research what they are doing and listen to this interview with NYDIG’s CEO

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Curiouser and Curioser

The government seems very curious about your crypto transactions

According to this report, the IRS has been authorized by a US court to seek the Identities of cryptocurrency users.

“Those who transact with cryptocurrency must meet their tax obligations like any other taxpayer”

Data released by Coinbase shows that the IRS is not the only government agency interested in your crypto:

In a controversial interview, Edward Snowden criticized Bitcoin’s lack of privacy (from min. 13:10 to 15:35)

His remarks are not wrong, but many felt it was an unfair characterization of the situation. There is no “easy privacy” switch, particularly at the base layer and while Taproot or Lightning won’t fix all of Bitcoin’s privacy problems immediately they are solid steps in the right direction.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Missed the Barn

The jobs forecast was off. Significantly. Dramatically even. In fact they had never issued a forecast that missed by such a wide margin

This is not a good sign at all. The long overdue crash —the one that’s been kicked down the road for more than a decade— seems to be getting closer.

Russia shopping for money

Surprising no one, Russia would prefer to avoid US sanctions and have the ability to transact freely. They are in the market for money that allows them to do that.

Woe is Me

The Bank of England doesn’t like Bitcoin. Right back at you Guv.

Govcoin

The Economist sung the praises of the non-existent but potentially imminent Panopticoins. Electronic fiat that will give governments unimaginable surveillance and control capabilities over its citizens.

They say these new currencies are “to be treated with optimism and humility”. I disagree with their learned opinion. I strongly suggest treating them with a firmly upraised middle finger.

One of the many angles to study when learning about Bitcoin is the role that governments have played in the issuance and control of money (hint: it’s impossible for them to resist debasement) and the subsequent importance of having a money that is not controlled by government.

The implications are as enormous as they are hidden from sight, but in case you are new to the subject know this:

Your money is broken (regardless of what country you’re from)

It was broken by governments present and past

A broken money is poisonous not just to humans but to the entire planet.

The positive impact of returning to sound money is hard to imagine.

You are faced with the alternative right now of choosing Bitcoin or submitting to the governments’ surveillance-coin.

There is no return from either path, choose wisely.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Accumulation

While most of the world is distracted with shitcoins, the smart money is accumulating Sats at ridiculously low prices, taking care not to push the price above $60k (lest the masses wake up from their shitcoin trance).

Bitcoin has spent a little more than nine weeks above the $50k mark.

The next big leg up is coming and all you have to do is nothing.

Never invest in something you don’t understand.

I help families, individuals and businesses develop an understanding of why and how to invest in Bitcoin. If you’d like to find out more schedule a free 30-minute call with me.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.17 - Distraction

Bending the Knee || Dave Portnoy: Bitcoiner || Nexon Next || Houses Not Coffee || Nevercoiners || CryptoTurkey || TurboTax || Red Candle

TLDR:

What I hate about alt-season —and we are in alt-season— is not that others are getting rich off shitcoins, it’s that my clients get distracted by the eye-popping fiat returns. Measure your wealth in sats not fiat.

THE STANCE

My personal opinion on where the ball might be heading.

“I wonder if I should buy some Dogecoin in anticipation of Elon Musk’s appearance on Saturday Night Live…”

Seems a reasonable thought. Elon is likely to make some stupid joke that will make Doge pump during his upcoming SNL appearance.

But then everyone knows that, so it’s probably priced in, and the price really hasn’t come down after that insane pump, has it?

I mean if it were at $0.008 or even $0.05 that’d be one thing, even $0.257 could be interesting but at $0.403?

See how easy it is?

I just wasted your time making you think about whether you should “invest” in Dogecoin.

DOGECOIN. The one coin in the space that’s honest about its claim to fame (and badge of honor): it’s a joke.

Now add to that dynamic fantastic claims about how “Shitcoin-X® is going to disrupt the breathing industry” and you quickly find yourself in the quicksands of shitcoinery.

Welcome to Alt-Season, where the pumps are real and rug-pulls happen to other (dumber) people.

You may be hearing about how Ethereum is at all time highs and will “flippen” Bitcoin and other such nonsense. I’ll try to make this brief and make my case using only two charts.

The first is Ethereum’s price making all-time highs:

The second chart shows Ethereum priced in Bitcoin instead of USD. As we can see it would have to slightly more than double its price to just to reach its previous All-Time-High.

The moral of the story is simple, but not easy: