2021.25 - In Memoriam

TLDR:

Whatever else this year has brought, one almost universal experience for most has been loss. Whether it was money, health, freedom, friends or enemies, there has been reason for mourning.

Stack Patiently.

THE STANCE

My personal opinion on where the ball might be heading.

1,000,000 Bitcoin

It’s been reported Mircea Popescu recently drowned in the sea in Costa Rica.

I’m not one to eulogize Popescu. He belonged to a different Bitcoin era than me and I only learned of his existence a few months ago. Despite my curiosity around how he came to own a million Bitcoin, I never really managed to dive into his blog or learn much about the man.

He does seem to have left deep marks on the early Bitcoin community, not all of them good.

40-Year old Popescu would have been worth a staggering 30 Billion or more today. News of his death made me grateful to have a little more time.

RIP MCafee

John McAfee allegedly committed suicide after learning his extradition to the US from his Spain had been approved. His wife denies he was suicidal. John claimed to have a trove of incriminating documents that would be release if he met an untimely fate

An Ethereum wallet that is believed to be McAfee’s executed some transactions after his death was announced… Whatever else one could say of John, he was never boring. May he rest in peace.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

El Salvador

First National Airdrop

The people of El Salvador will receive US $30 to their wallets, marking the first time in history that a government will “airdrop” (give away) Bitcoin to its citizens.

President Bukele delivered a widely praised address (original in Spanish below) in which he detailed the spirit and specifics of the recent Bitcoin law, addressing some of the many concerns his citizens have been voicing after the recent law was passed in a rapid manner.

Billionaire Thangs

Azteca Pushing for Bitcoin

After a recent interview in which he demonstrated a solid understanding of the basic investment thesis for Bitcoin, Ricardo Salinas Pliego —Mexico’s third richest man who had previously disclosed he has 10% of his liquid assets in Bitcoin — dropped some surprising news in a casual conversation with Michael Saylor:

“Bitcoin should be part of every investor’s portfolio”

—Ricardo Salinas Pliego

The Talk

Jack Dorsey announced “The B Word” an event to help institutions embrace Bitcoin. After the announcement some friendly-if-childish banter led to Elon Musk accepting Jack’s invitation to come and discuss all things Bitcoin.

I’m not holding my breath about Elon’s role regarding Bitcoin becoming a net positive, but if he could be convinced to not add further damage that would be great.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Exodus

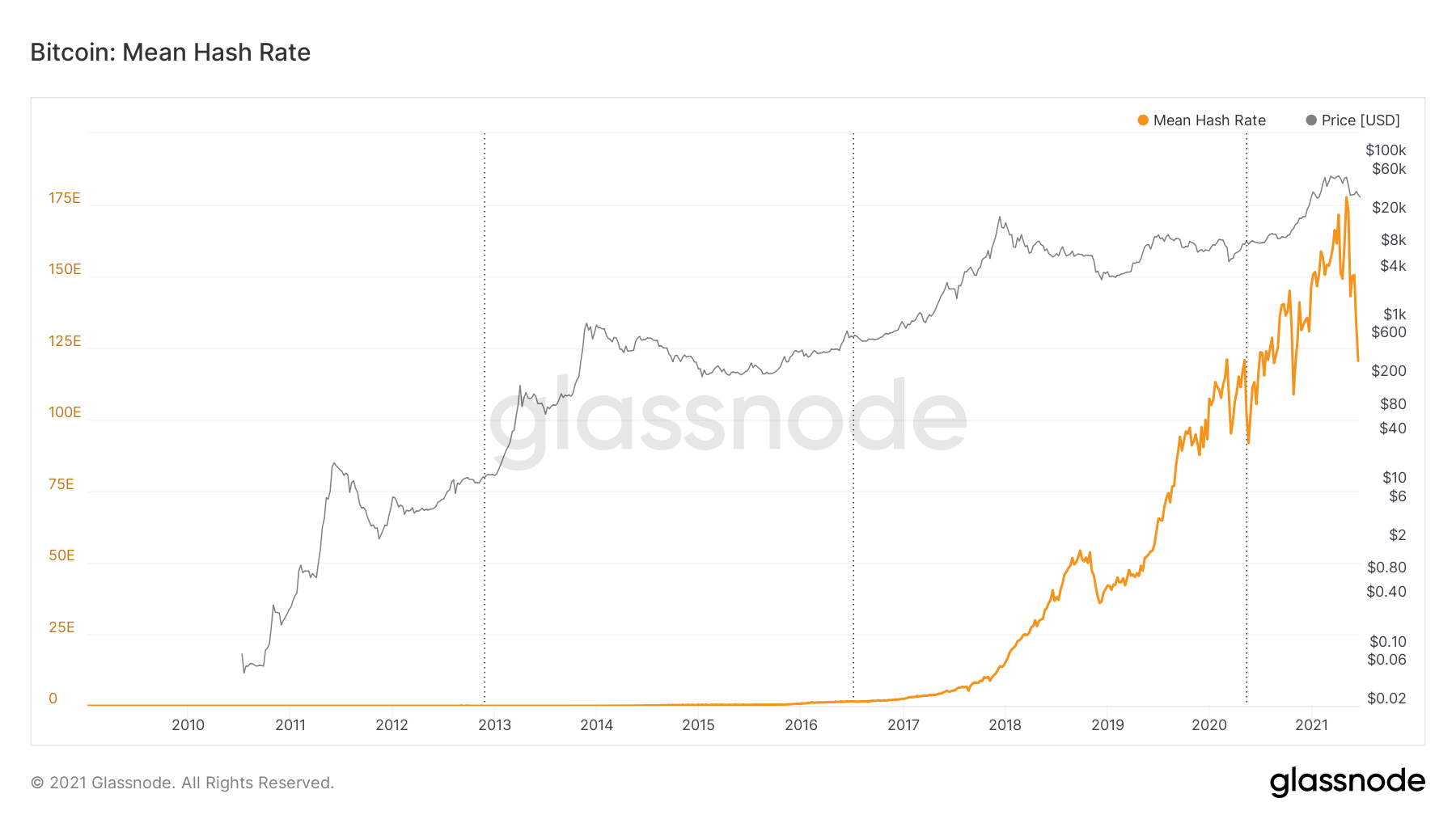

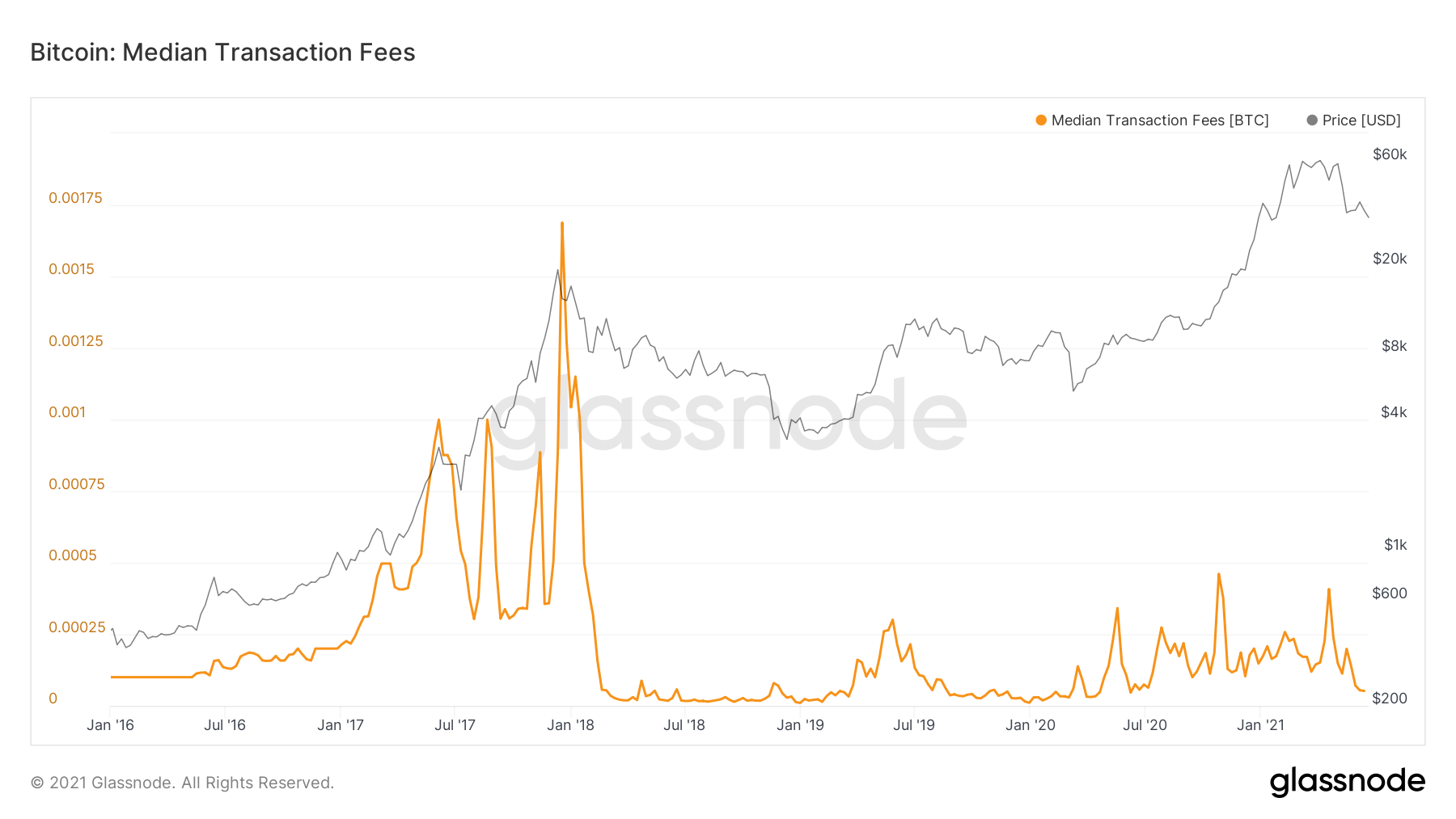

Hash rate continued to drop as Chinese miners prepare to migrate, however transaction fees not been impacted.

It’s hard to know what China is really planning at any given moment. Speculation abounds about whether they are really committing a huge blunder or playing some version of 4D-chess. The narrative being pushed is that China is trying to limit access to risky financial speculation:

There have also been questions about the extent to which this miner migration is affecting the price of Bitcoin

50 shades of Rug Pulls

The best way to understand the concept of a “rug-pull” —a fairly common occurrence in “crypto” (aka shitcoinery) and one of the reasons I advocate a Bitcoin-only portfolio— is through an example or two, (or three). While the basic dynamics are the same, they can come in various flavors:

Cuban Rug

Let’s assume you are a fictitious billionaire named Mark with a large Twitter following, you tell your followers you are investing in an asset which has been rising rapidly. As your followers decide to get in on the trade you and your insider friends sell your entire positions for a hefty profit, cratering the price of the asset:

In order to be able to do it again you must claim to be one of the victims. Bonus Points if you add insult to injury by brazenly calling for regulations to stop this kind of thing from happening.

Pal Rug

This method takes a lot of work, you need to build a platform to which people come for advice / learning. Obviously you have to provide some value in order to attract an audience, but in between your nuggets of wisdom you lend credence to scammy projects by giving them airtime and acting impressed at their potential Bonus points if you charged the scammers for appearing and/or the marks the audience for accessing the content)

In order to be able to do this more than once you need to feign ignorance about the technical workings of blockchains and focus exclusively on the marketing narrative.

Love Rug

This one is rare because it makes the least sense. It starts with you genuinely loving Bitcoin and working really hard to promote it in earnest.

But the lure of free money beckons. Except this money isn’t free. It comes at the potential cost of your reputation.

You see, a team recently created a run-of-the-mill altcoin with a twist: it’s value goes up and down along with your “reputation” and if you want to claim your money you have to do so publicly on Twitter, hereby marketing the product however reluctantly.

You can read his verbose description of the “ordeal”

Here’s how I interpreted it in real-time:

Robert tries to unlock his Bitclout profile to dump the coins, but bungles the link and the profile remains unclaimed:

Facing backlash, he assumes a defensive stance

He “tries to warn” his upcoming victims in an an oblique manner:

By one account, Robert Breedlove decided to do just that. He claimed his profile, received his tokens and sold them for Bitcoin. Personally, I don’t have much of an issue with that. BUT the devil is in the details.

The problem —for me— was that instead of doing it brazenly he “asked permission” first, when confronted with the implications of what he was about to do he tried to cloak the whole thing under a disingenuous guise of free intellectual inquiry, villified the community (including former friends) for trying —in their own admittedly toxic and overboard way— to prevent him from committing reputational seppuku, pulled the rug (for a little over $30k to be donated to Bitcoin developers) and came out of the ordeal claiming both victimhood and moral victory in a looooong essay.

The whole thing was sad to witness.

While I agree that Bitcoiners can go overboard in their race to be most toxic and I support the need to remain inquisitive, Bitclout was fairly obviously not a deserving hill to die on. We should not pretend otherwise.

I hope Breedlove is able to return to the Bitcoiner community one day, but the latest interactions I’ve seen leave me with little hope of this happening.

Finally, the denouncement of toxicity is a requisite of all rug-pullers. I will one day see toxicity blamed for interfering with honest inquiry, this was not that day.

Tether Heating Up

With increasing talk of regulation coming to the crypto markets in general and stablecoins in particular, Tether seems to be firmly in the crosshairs

Tether is like the main killer in a slasher movie. Every time you think you’ve dealt with it, it pops back up. Where do we stand?

It’s hard to summarize Tether. It’s supposed to be a fully backed stable-coin (with one dollar in reserves for every Tether issued). The question of whether or not they are fully reserved has been definitively settled: They are not, not by a long shot.

Just how solid their reserves are remains the subject of speculation as the reserve information they disclosed was rather opaque.

This leaves us with the question of how serious of a problem this is.

Opinions here range from “not serious at all” to “they will bring down the entire market”. My personal suspicion is that the truth is somewhere in the middle.

I’ll leave some interesting threads below, my current perception of Tether is:

It’s trying to be “The Fed” of Crypto with all the good and bad that entails

It’s withstood pretty savage swings without breaking so far

Regulators will come after it with gusto

Fully-backed competitors are on the horizon, but their buttoned-down nature may not allow them to serve some of Tether’s key markets.

A good part of the Tether risk has been assimilated into current prices. No sophisticated participant today will be able to claim to be surprised that Tether was not fully-backed.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Cantillionaires

It’s good to be close to the money printer.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Price holding its range despite the Chinese ban and regulatory FUD. Stack patiently

Dip Fishing

No news here, smart money still accumulating. Weak hands capitulating

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.