The Bitcoin Review was the previous incarnation of my newsletter.

2021.28 - Myopic

Miller’s Darling ~ Limitless ~ Banking on Bitcoin ~ Not Blackrock ~ Conflicted ~ The Great Silencing ~ Stable Regulators ~ Powell Moves ~ Much Immutable ~ Hot Garbage ~ Temporary Right?

TLDR:

Is this a normal day or is a major shitstorm brewing? Rhetorical question. Your choices: the myopic comfort that leads to serfdom or the difficult carving-out of a perilous path which may lead to freedom.

THE STANCE

My personal opinion on where the ball might be heading.

If you look at the stock market it would seem the economy is doing well, with major indices being up 12% or more year-to-date.

US Households seem to have embraced the “stocks-only-go-up” paradigm as they are now invested in the market in record numbers.

It’s hard to blame them —when inflation is high (which it is), you use your depreciating money to buy assets hoping they’ll appreciate as cash depreciates. But are they aware of how precarious the situation is?

I have no idea how much longer the Fed can keep the money printers on high with the interest rates on low. I just know it can’t go on indefinitely because math.

I also don’t know how the Fed could extricate itself from its current position without detonating an epic and global fireworks storm.

Add some lines of tension courtesy of China’s looming protein shortage and it’s lustful intentions for Taiwan, home of Taiwan Semiconductor —perhaps the single most valuable company in the planet.

Then whisk in some totalitarian moves, like Maricon’s Macron’s recent proposal to jail unvaccinated epicureans or the White House’s recent suggestion to omniban thought-criminals from all social media or (my personal favorite) Dr. Evil’s Klaus Schwab’s threats of the impending cyberattack which will force us to go offline (don’t laugh this one off).

For the grand finale, top it all with $90’ish trillion dollars in bonds with negative yields and a good portion of the tax-revenue-generating population still locked down and receiving stimulus checks.

I sometimes envy my no-coiner friends who maintain a state of blissful unawareness and are utterly unconcerned about any of this.

Looking a few years into a future sets me straight again.

Strengthen the body, sharpen the mind, cultivate your tribe and stack sats. Myopia is not bliss.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Miller’s Darling

Billionaire Bill Miller gets Bitcoin so this is not a shocker, still it’s nice to see that his holdings surpass those of his favorite stock.

Limitless

Paypal keeps upping its Bitcoin game, raising weekly buy limits and eliminating annual limits. Still it’ll be interesting to see them compete with Lightning Strike’s upcoming zero-fee purchases.

Banking on Bitcoin

Two big US banks with Bitcoin announcements this week. Institutions keep staking their turf in Bitcoin.

Not BlackRock

Black Rock Petroleum —not to be confused with the largest asset manager in the world— announced they’ll be deploying one million miners to their Alberta field. They may not be Blackrock, but that’s a lot of miners.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Conflicted

Not sure how I feel about this one. I fully support Bitcoin-based DeFi but I share Beautyon’s concerns about this (well-funded) effort potentially thwarting the work of independent developers

I often like what Jack says about Bitcoin but dislike what his companies do. I’m not sure why TBD would be the exception to this.

The Great Silencing

Are you thought-divergent, friend?

If you are, get ready for the exciting experience of being deplatformed. The White House is getting aggressive against those who don’t toe the party line (with special emphasis emphasis on those who question vaccinations).

The Ministry of Truth approves of this message and so do you unless you want a friendly visit from the thought-police.

Don’t forget: We have always been at war with Eurasia.

Stable Regulators

Rumors about new crypto-regulations with a double serving for stablecoins have been making the rounds for a while. Seems the time is nigh.

Powell Moves

Powell made the rounds denouncing crypto as useless and putting stablecoins on notice as he prepares to launch a cryptodollar.

“If [stablecoins] are going to be a significant part of the payments universe — which we don't think crypto assets will be, but stablecoins might be— then we need an appropriate regulatory framework.” - Jerome Powell before a congressional subcommittee

Much Immutable

This should not be possible to do in a blockchain.

That’s all I have to say about that.

Hot Garbage

BSV —one of the most despised projects in crypto, courtesy of its clown of a founder— seems to have run into some trouble last week (seems it was 51% attacked)

GOOD.

BSV still about $123 too expensive for me, but once it hits zero, I’ll pour one out for Faketoshi (the creep behind BSV).

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Temporary Right?

US consumer prices —excluding food and energy because who cares about those amirite?— are rising faster than the Fed would like to admit.

Powell and the Gang are trying to convince us the inflation is either temporary or good news, but not everyone seems to agree.

“I BELIEVE THAT SIGNIFICANT INFLATION WILL CONTINUE FOR MANY MONTHS LONGER”. — Janet Yellen, US Treasury Secretary

“I DO NOT BELIEVE INFLATION IS TRANSITORY” — Larry Fink, CEO Blackrock

The chart below compares interest rates with inflation, I don’t want to argue whether it makes sense to compare them, I just find it a visually interesting representation of how deeply unusual the current situation is.

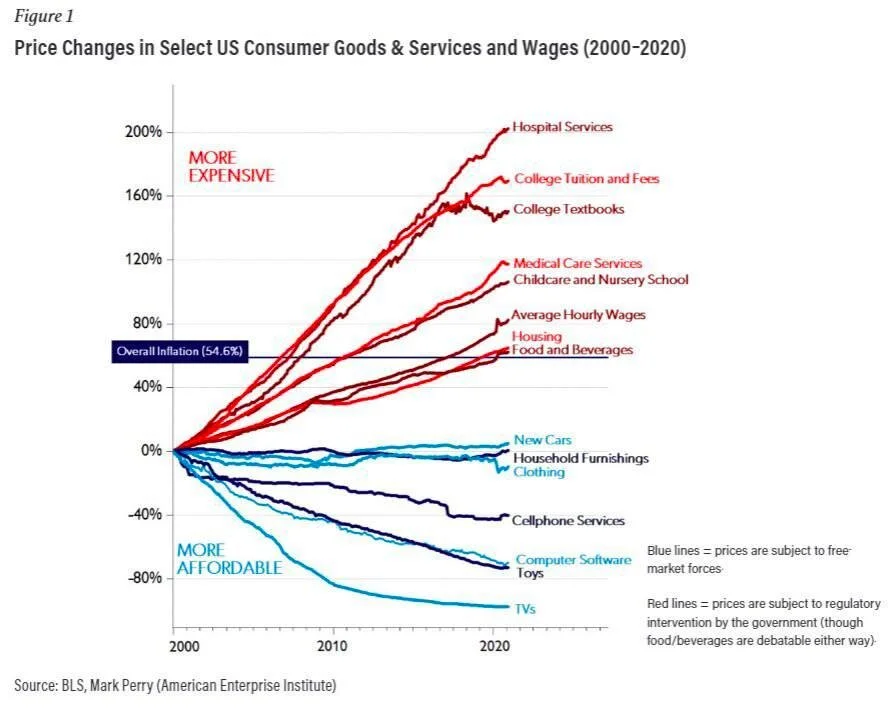

And if the inflation rate doesn’t seem THAT bad, just remember that the CPI is a highly manipulated number that understates real inflation:

I very highly recommend you view this excellent 15 minute video on inflation, based on an article by Lyn Alden.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Bitcoin Surfing

Bitcoin has been unable to hop on the board, rather it would seem that “the board” bonked Bitcoin on the head and pushed it lower.

Dip Fishing

Still firmly stuck in the “Surprising” range, we’ve been heading lower this week.

I expect this week’s regulatory news —and the likely pushback against Tether— to have an effect on price on way or another. If bearish we may break below the $30k level, after all the “hard floor” (as we can see in the Bitcoin Surfing chart) is all the way below $15k.

I still don’t think we’ll drop below $30k but the trend lower is clearly there.

For the moment, we stack and wait.

The Calm Chart

Remember: We’re going to be fine.

Clear your mind and take two deep, slow breaths while drinking in the chart below.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.27 - Fake

Institutional Interest Holds || Bitcoin Politics || Bitcoinstar || Wyndham Rewards || Deez Information || “Cyberpandemic” || Absolute Control || Incoming || Hate the Game… || Exodus Update || BTC > NYSE || Problems in Fiatlandia || Something About Snitches || Libertad

TLDR:

The fight to control the narrative is kicking into overdrive, the battleground is your mind.

Educate yourself or be indoctrinated, your choice is likely to echo deep into the future.

THE STANCE

My personal opinion on where the ball might be heading.

As far as you are concerned, the ultimate arbiter between Fact and Fiction is your brain. You assemble your world view by selecting data that fits within your mental models.

Changing these models is usually difficult and uncomfortable. Most people would rather not.

When reality changes and your models get broken. You have the jarring experience of being shoved involuntarily into new sense-making.

New narratives must be found to make sense of the world. And lo and behold there’s a barrage of voices with ready-made narratives to “make things easier for you.”

Let’s our recent lockdowns as one example. I don’t know/care if you are for or against lockdowns, that is beside the point right now.

Are lockdowns effective?

Were lockdowns always part of the plan in case of a pandemic?

Have you actually researched either of these questions?

If it turned out the lockdowns were both a last-minute decision and known to be ineffective, would that be upsetting to you?

How hard would it be to swallow the quote below?

There are no historical observations or scientific studies that support the confinement by quarantine of groups of possibly infected people for extended periods in order to slow the spread of influenza. … — See original article

Ironically, this rant is not about lockdowns, but rather about sense-making. Your ability to make sense of the world is about to be severely tested.

As the monetary engine of the world struggles to keep up with reality a number of familiar things will probably break down and you will forced to choose between different ideas of what money should be.

There is already a campaign underway to steer you towards a money that is tightly controlled by governments, after all they know best. RIGHT?

For the first time you have the option of choosing a money that is not friendly to government manipulation. This is a threat to those who greatly benefit from having their fingers on the monetary levers of the world. They will not give up that control easily, you can rest assured they will fight to keep and increase the control they already have.

The battlefield will be your mind.

You would do well to take this opportunity and build an informed position on what it means for something to be “good money.”

What’s at stake is not just your financial prosperity but also your ability to choose how to lead your life.

This is likely to be a definitive battle for future generations as well, we stand at a crossroads which we may not visit ever again. You have the ability to choose freedom today. Your children may not get to make that choice tomorrow if you forfeit now.

If Bitcoin’s volatility scares you, just broaden your time horizon. This is the time to choose wisely.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Institutional Interest Holds

Despite the range-bound price action (price basically hovering around $35k) the real-world Bitcoin interest from institutions is alive and well.

Bitcoin Politics

By conviction or convenience, expect to see an uptick in politicians around the world leveraging their positions on Bitcoin (pro and con) as part of their platforms.

Rumors about Paraguay have been growing louder lately. We already know a Bitcoin bill will be presented this week so we are not sure what Mr. Rejala’s “surprise” will be but are looking forward to it. A second nation adopting Bitcoin as legal tender would be phenomenal news.

Bitcoinstar

Turn your spare change into sats. Love this idea.

Wyndham Rewards

Already a growing phenomenon in the credit card industry, “Bitcoin rewards” are likely to become a de facto standard across industries IMO. Wyndham is sounding the starting gun for the Hotel industry.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Deez Information

It should be fairly obvious by now that we are smack in the middle of the information wars. The attempts to steer the public narrative with flawed information is rampant in multiple domains.

With American Hodl leading the charge, Bitcoiners decided to have fun with this. They changed their avatars to bland institutional-ish names and logos and started reporting (mostly bullish) fake Bitcoin news.

And, Mission Accomplished, a few news outlets picked up the items and reported them as real news:

“Cyberpandemic”

WEF Director and Dr. Evil understudy Klaus Schwab has an uncanny record of causing predicting catastrophic events. The WEF’s COVID “simulation exercises” directly preceded the pandemic by a couple of months. It seems that may have just been the warm up act.

One widely expected outcome of these “cyber pandemics” and their resulting financial mayhem is that governments will try tops CBDCs and crack down on Bitcoin and other digital assets.

Arguably the most troubling part of the report, however, is its call to unite the national-security apparatus and the finance industry and then use that as a model to do the same with other sectors of the economy. —Whitney Webb, WEF Warns of Cyberattack Leading to Systemic Collapse of the Global Financial System

And. Like. Clockwork.

Absolute Control

If you are wondering what the endgame is around all of this nonsense is, you can find out in less than two minutes.

While not new, the following clip has been circulating a lot lately and it is relevant because governments would much rather have you using CBDCs than Bitcoin.

The key takeaway (lightly paraphrased):

“…We don’t know who is using a USD$100 bill today…

…a key difference with the CBDC is that the central bank will have absolute control on the rules and regulations that will determine the use of that [money] and also we will have the technology to enforce that.” —Agustin Carstens, Bank of International Settlements

So far, countries that have tried to ban Bitcoin have not been very successful. Expect future attempts to be more sophisticated than outright bans and expect fiat economists like Prof. Hanke to cheer them on

Incoming

There have been rumors of new “crypto regulation” coming to the US for several months now.

While no one seems to know exactly what will be proposed yet, I expect a lot of attention will be placed on Stablecoins, which the quote below seems to refer to

“…could fuel financial panics if users come to doubt the value of the underlying collateral. It will be practically impossible for Treasury and FSOC not to examine the financial stability risks of digital assets and how they can use their authorities to address those risks,” — David Portilla, Obama-era Treasury staffer

Hate the Game…

Guggenheim’s Scott Minerd lays bare the simple games big money plays to manipulate market sentiment:

Before Selling: Release ultra-bullish prediction to pump the market

While Accumulating: Release ultra-bearish prediction to depress price.

Supply “reasons” for each case. Rinse and repeat.

Sinple.

Exodus Update

As we’ve discussed in previous weeks, loads of miners are leaving China looking for more friendly jurisdictions, USA being a premier destination. Hash rate looks like its starting to recover, which suggests some of these miners are up and running again

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

BTC > NYSE

The ex-president of the New York Stock Exchange (2014-2018) has signed on to lead a Peter Thiel-backed crypto-exchange

“Digital assets are here to stay. The smartest engineering talent is going into digital assets; digital assets are solving very important problems. Anybody who tells you they know exactly how it’s going to turn out is lying or delusional, but in general, you’re going to see more and more interesting use cases, more and more dollars go into the space,” — Tom Farley

Problems in Fiatlandia

One of the problems with debt-based money is that the debt cycle tends to spin out of control. And while interest rates can be an effective tool to manipulate the appetite for credit early in the cycle, they lose effectiveness in the later stages of the game.

It’s as if the Fed has infinite bullets, but the bullets grow softer and softer the more they use them.

If all of this is confusing to you, know you are not alone. The Fiat Machine is very complicated:

Something About Snitches

The FBI is encouraging you to spy on and report your neighbors and family. If only we had some precedents about this going horribly wrong…

Libertad

Large protests in Cuba saw citizens chanting “Libertad” (freedom). Interestingly, the New York Times labeled this as anti-government speech

But inflation can’t happen here, right?

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Back on the Board?

Bitcoin has been treading water for a while, but it’s “board” finally came within arm’s reach ($35.5k). Will Bitcoin be able to get back on the board and prop itself higher?

To me it’s a question of when, not if.

Still hanging around $35k Not much to report yet.

I know I’ve said this before but it’s worth repeating: This is a great price at which to buy.

Big Moves?

I’m not a trader, so I won’t try to offer color here. Just an FYI that people who do trade expect a bit movement soon (just not sure in which direction, as per usual)

The Calm Chart

Remember to relax, this dip will be a distant memory sooner than you think.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.26 - Dragons

Bolts Fired || Soros Enters Chat || No Inflation || Petrodollar Woes || Mine || Fiat Times || Grayscale Arb || Under the Surface || The Calm Chart

TLDR:

China has been leading an aggressive attack on Bitcoin and crypto. Bitcoin is holding its ground and will come out stronger.

THE STANCE

My personal opinion on where the ball might be heading.

As predicted, the FUD factory has been going all out on Bitcoin and crypto in general. Real-world actions combine with misinformation to create a potent mix of Fear, Uncertainty and Doubt.

China has been leading the charge prompting onlookers to question what type of long game they are playing, what their real motivation and intentions are being their recent actions.

While I am also skeptical that China would commit such a colossal blunder, the effect of miners shutting down in China is palpably real, mining difficulty just had one of its largest drops ever, making mining more profitable for those who were able to keep their machines on.

In this image you can see the daily revenue generated by one miner and there’s a visible uptick in July 3rd.

It will take some time before the Chinese miners can find a new home for their machines, the next few months are likely to be the most profitable that the remaining miners will ever see.

The decentralization of mining outside of China will be a huge gift for Bitcoin as it should put to rest one of the more common sources of FUD: Chinese influence on Bitcoin.

If you want to see a more detailed breakdown of how these informational wars play out CroissantEth put together a good compilation here

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Bolts Fired

Jack Mallers is not one to rest on his laurels.

Taking aim at the crypto exchange industry, he just announced you’ll soon be able to use Lightning Strike to buy Bitcoin easily and for virtually no fee (0.3% as opposed to Coinbase’s 3.99%)

Besides taking a free good swipes at Coinbase and other exchanges, the announcement also gives us a glimpse of some of Strike’s upcoming features, which are very exciting.

Jack is using Bitcoin to change the way people use money and it’s beautiful to see.

NCR + BTC

The 135-year old firm is one of the largest providers of point-of-sale software for the retail and restaurant industries as well as a manufacturer of ATMs and cash registers.

It also provides banks with digital banking services and now, through a new partnership with NYDIG, it offer banks a turnkey solution through which they’ll be able to offer Bitcoin to their customers.

This is very bullish in my opinion. As much as “Big Money coming into Bitcoin” sounds exciting, institutional investors are also highly sophisticated, mercenary and agnostic in their approach to investing. The best thing for Bitcoin are hodlers with conviction and I’m confident we’ll find some of those among the banks’ 24 million customers.

Torn Legislators

There is still no agreement on Bitcoin among US legislators. I’m grateful that there are well-informed members who have taken the time to educate themselves and can articulate the case for Bitcoin, but the recent and soberly titled “America on FIRE” hearings showed that there’s a long way to go education-wise.

Meanwhile…

The process of watching the world adopt an asset like Bitcoin brings to mind a famous quote:

“The future is already here, it’s just not evenly distributed.”

—William Gibson

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Soros Enters The Chat

There are few names as polarizing as George Soros. He joins the list of “Masters of the Universe” that will be playing with Bitcoin. This was bound to happen at some point and is part of Bitcoin’s coming of age.

The list of “Big Names” in Bitcoin has grown into a who’s who of investing. There are some people that I never expect to see on the list, like Warren Buffet and Charlie Munger, but enough of them are here to ensure one thing:

We have a wild ride ahead of us. You can rest assured that these pros will try to “shake you off the horse”. You’ll need a strong conviction to hold through Bitcoin’s next phase.

Spell out your investment thesis, learn how Bitcoin works, why it matters and how you can use it to protect your sovereignty.

You’ll need conviction for what’s coming.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

no Inflation

This chart is a great way of visualizing why the CPI is essentially useless: inflation does not hit all asset classes evenly.

Petrodollar Woes

I don’t know what’s going on in the world of maritime oil refining, but three accidents last week seems statistically unusual.

This reminds me of something a friend once taught me “Once is happenstance, Twice is coincidence, Three times is enemy action”

MINE

Spain’s proposed new law should serve as an urgent reminder of government’s tendency to overreach their boundaries and trample individual rights and freedoms.

Fiat Times

The Financial Times penned a rather pathetic plea to stop calling dollars “Fiat Money” the comments below the tweet are worth your time.

In the article the author explains that the dollar is not “backed by nothing” but rather backed by promises to pay.

“You may believe the US government will not be able to collect enough taxes to roll over those Treasury bills. If you are right, then yes, the dollar has no value.”

—Brendan Greely, Financial Times

The estimated US deficit for this year is north of two trillion and irony is dead.

PRICE ACTION

This is the section where WE talk about price. If this is your first time here You’ll find a “how to interpret” guide by Hovering over the "chart.

We have been hugging $35k for over 6 weeks now, I don’t know how much longer we’ll linger here but aggressive efforts to push Bitcoin below $30k have been unsuccessful so far.

My personal suspicion is that we won’t stay here much longer

You see, Bitcoin has never had 4 consecutive red months during a bull run (in fact we already broke precedent by having 3). This doesn’t mean it can’t happen, but it would be a first.

This would not make sense to me but it’s true that the caliber of players trying to manipulate the price is now world-class and as we all know the market can remain irrational longer than you can remain solvent. So we stack sats and hodl patiently.

Of course one interpretation is that the bull run is over and we’re now in a bear market. I don’t believe this at all.

While it’s dificult (impossible?) to fully understand the Price Discovery process, it’s sometimes helps to understand some of the big tectonic movements that affect its dynamics. Like the Grayscale Arb Trade.

Grayscale Arb Trade:

Grayscale offers a fund (GBTC) that owns Bitcoin and can be traded in the stock market. For a while you could make “free money” by timing your buying and selling of it. When this stopped being true, a large engine of demand for Bitcoin was switched off.

At one point, GBTC was the only vehicle through which you could gain exposure to Bitcoin in the stock market, which meant it was the only way for certain investors and institutions to own Bitcoin. For that reason, it traded at a premium —it was more expensive to buy Bitcoin through the fund than to buy Bitcoin in the open market.

This opened the door for an arbitrage play: You could make “free money” (you could pocket the premium) if you were willing to wait 6 months. This drove great demand for the fund, which in turn, purchased large quantities of Bitcoin.

As other options started to become available for institutions / investors to gain exposure to Bitcoin globally, the premium shrank and eventually inverted. You can now '“buy Bitcoin cheaper” than market price by buying GBTC instead. This pulls demand away from Bitcoin.

Lyn Alden masterfully walks you through the whole thing:

Under the Surface

In the thread below Travis Kling brings the point home. Over the past few months there have been number of events that increased the level of uncertainty around Bitcoin. What does the China ban really mean? Are ESG investors going to shun Bitcoin? etc.

The battle between those betting on which direction this will take Bitcoin can be seen on the charts. And what the charts have shown is Bitcoiners holding the price floor despite aggressive shorting. Hodl Strong.

The Calm Chart (New!)

We’re going to be fine.

Take a breath and spend a quiet moment drinking in this chart:

Strong hands are built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.