2021.28 - Myopic

TLDR:

Is this a normal day or is a major shitstorm brewing? Rhetorical question. Your choices: the myopic comfort that leads to serfdom or the difficult carving-out of a perilous path which may lead to freedom.

THE STANCE

My personal opinion on where the ball might be heading.

If you look at the stock market it would seem the economy is doing well, with major indices being up 12% or more year-to-date.

US Households seem to have embraced the “stocks-only-go-up” paradigm as they are now invested in the market in record numbers.

It’s hard to blame them —when inflation is high (which it is), you use your depreciating money to buy assets hoping they’ll appreciate as cash depreciates. But are they aware of how precarious the situation is?

I have no idea how much longer the Fed can keep the money printers on high with the interest rates on low. I just know it can’t go on indefinitely because math.

I also don’t know how the Fed could extricate itself from its current position without detonating an epic and global fireworks storm.

Add some lines of tension courtesy of China’s looming protein shortage and it’s lustful intentions for Taiwan, home of Taiwan Semiconductor —perhaps the single most valuable company in the planet.

Then whisk in some totalitarian moves, like Maricon’s Macron’s recent proposal to jail unvaccinated epicureans or the White House’s recent suggestion to omniban thought-criminals from all social media or (my personal favorite) Dr. Evil’s Klaus Schwab’s threats of the impending cyberattack which will force us to go offline (don’t laugh this one off).

For the grand finale, top it all with $90’ish trillion dollars in bonds with negative yields and a good portion of the tax-revenue-generating population still locked down and receiving stimulus checks.

I sometimes envy my no-coiner friends who maintain a state of blissful unawareness and are utterly unconcerned about any of this.

Looking a few years into a future sets me straight again.

Strengthen the body, sharpen the mind, cultivate your tribe and stack sats. Myopia is not bliss.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Miller’s Darling

Billionaire Bill Miller gets Bitcoin so this is not a shocker, still it’s nice to see that his holdings surpass those of his favorite stock.

Limitless

Paypal keeps upping its Bitcoin game, raising weekly buy limits and eliminating annual limits. Still it’ll be interesting to see them compete with Lightning Strike’s upcoming zero-fee purchases.

Banking on Bitcoin

Two big US banks with Bitcoin announcements this week. Institutions keep staking their turf in Bitcoin.

Not BlackRock

Black Rock Petroleum —not to be confused with the largest asset manager in the world— announced they’ll be deploying one million miners to their Alberta field. They may not be Blackrock, but that’s a lot of miners.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Conflicted

Not sure how I feel about this one. I fully support Bitcoin-based DeFi but I share Beautyon’s concerns about this (well-funded) effort potentially thwarting the work of independent developers

I often like what Jack says about Bitcoin but dislike what his companies do. I’m not sure why TBD would be the exception to this.

The Great Silencing

Are you thought-divergent, friend?

If you are, get ready for the exciting experience of being deplatformed. The White House is getting aggressive against those who don’t toe the party line (with special emphasis emphasis on those who question vaccinations).

The Ministry of Truth approves of this message and so do you unless you want a friendly visit from the thought-police.

Don’t forget: We have always been at war with Eurasia.

Stable Regulators

Rumors about new crypto-regulations with a double serving for stablecoins have been making the rounds for a while. Seems the time is nigh.

Powell Moves

Powell made the rounds denouncing crypto as useless and putting stablecoins on notice as he prepares to launch a cryptodollar.

“If [stablecoins] are going to be a significant part of the payments universe — which we don't think crypto assets will be, but stablecoins might be— then we need an appropriate regulatory framework.” - Jerome Powell before a congressional subcommittee

Much Immutable

This should not be possible to do in a blockchain.

That’s all I have to say about that.

Hot Garbage

BSV —one of the most despised projects in crypto, courtesy of its clown of a founder— seems to have run into some trouble last week (seems it was 51% attacked)

GOOD.

BSV still about $123 too expensive for me, but once it hits zero, I’ll pour one out for Faketoshi (the creep behind BSV).

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Temporary Right?

US consumer prices —excluding food and energy because who cares about those amirite?— are rising faster than the Fed would like to admit.

Powell and the Gang are trying to convince us the inflation is either temporary or good news, but not everyone seems to agree.

“I BELIEVE THAT SIGNIFICANT INFLATION WILL CONTINUE FOR MANY MONTHS LONGER”. — Janet Yellen, US Treasury Secretary

“I DO NOT BELIEVE INFLATION IS TRANSITORY” — Larry Fink, CEO Blackrock

The chart below compares interest rates with inflation, I don’t want to argue whether it makes sense to compare them, I just find it a visually interesting representation of how deeply unusual the current situation is.

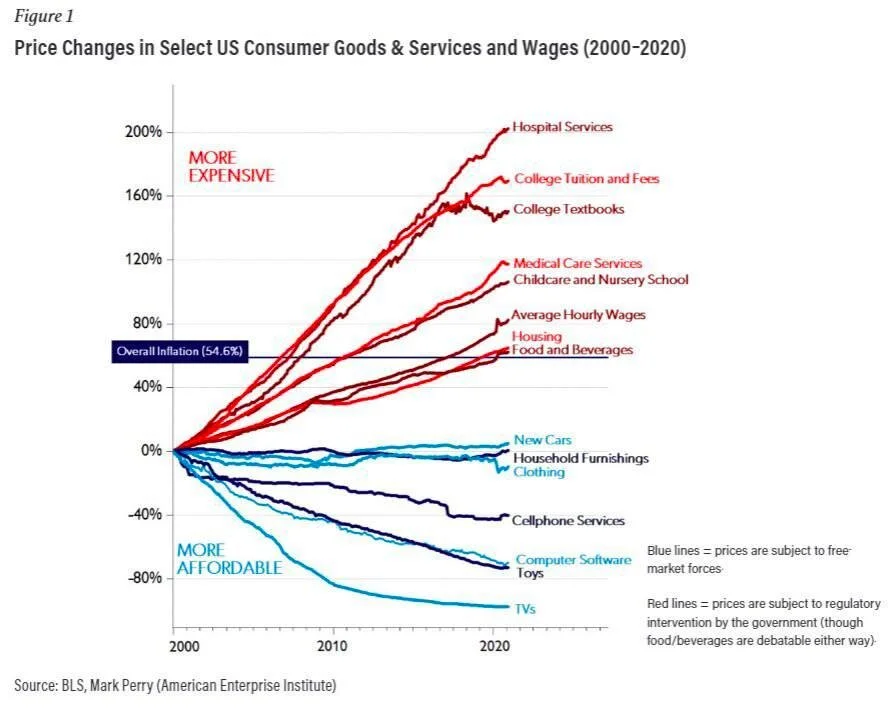

And if the inflation rate doesn’t seem THAT bad, just remember that the CPI is a highly manipulated number that understates real inflation:

I very highly recommend you view this excellent 15 minute video on inflation, based on an article by Lyn Alden.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Bitcoin Surfing

Bitcoin has been unable to hop on the board, rather it would seem that “the board” bonked Bitcoin on the head and pushed it lower.

Dip Fishing

Still firmly stuck in the “Surprising” range, we’ve been heading lower this week.

I expect this week’s regulatory news —and the likely pushback against Tether— to have an effect on price on way or another. If bearish we may break below the $30k level, after all the “hard floor” (as we can see in the Bitcoin Surfing chart) is all the way below $15k.

I still don’t think we’ll drop below $30k but the trend lower is clearly there.

For the moment, we stack and wait.

The Calm Chart

Remember: We’re going to be fine.

Clear your mind and take two deep, slow breaths while drinking in the chart below.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.