The Bitcoin Review was the previous incarnation of my newsletter.

2021.34 - Pay Me

One Year Later • Billions and Billions! • DEX’d • Institutions Bitcoining • Billionaires Bitcoining • Countries Bitcoining • Trading Africa • Getting Down To ASICS • You Are Early • Substacking Sats • Real ETH, Please Stand Up • ETFs - ETH • Iran No ban • Visa Apes In • China: MOAR Crackdown • Losing the Faith • Seize This • Muh Stonks • Dinosaurs Yell At Meteors • Out with the Old • The Blowoff

TLDR:

Bitcoin is already unrivaled as a long-term savings technology and settlement network for large payments. The era of lightning-enabled payments is about to officially kick off.

Can you see where this is going?

THE STANCE

My personal opinion on where the ball might be heading.

Stance

The use cases for Bitcoin are, in some sense, emergent properties that come into focus as people continue to subscribe to its incentive structure, helping it bootstrap itself into existence. Some are buying and holding, others are mining, others are trading and others are building on top of it.

Understanding this makes it easier to understand why some early adopters got it so wrong, like Roger Ver dying on the heal of cheap, fast payments. It may have made sense at the time given Bitcoin’s scale at the time but he ultimately lacked the vision to grow out of his position.

Right now Bitcoin is unrivaled as a long-term savings technology, and as settlement network for large payments, both of these features rest on the reliability of on-chain transactions on its base layer

But Bitcoin use cases are about formally to jump into a new phase. Ironically, fast, cheap and easy payments are coming to Bitcoin. Just not on the base layer.

I highly recommend this thread by Gigi for a thoughtful exploration of the contrast and tension between Bitcoin as a payments technology VS Bitcoin as a savings technology

The adoption of Bitcoin as a savings investment technology is still in its early stages. Most people have not yet made the leap into this alternative system —many of them out of mistrust or fear of these new rails. I see it all the time; people who are interested in the asset but struggle with the idea of digesting an entirely new financial ecosystem.

Add to the mix that the loosely regulated state of crypto-exchanges attracts many but probably repels the more conservative types.

The cherry on top is the fact that most people don’t yet know how to value Bitcoin (there are people out there who still think it could go back to $10k).

I favor a “Keep it simple” approach. Look at some of the stores of value that Bitcoin is competing against and arbitrarily assign a reasonable percentage that you feel it could absorb off that market.

For example, absorbing 100% of the Gold market would put Bitcoin around $500,000 per coin, but 100% is unlikely. Plug in a number that you feel is reasonable.

Below is this same exercise applied to the global debt market with a 10% as a target:

You could do the same for real estate and a number of other asset classes and the one thing that you’ll immediately realize is that Bitcoin is still massively undervalued.

It will be interesting to see how Bitcoin’s next chapter as an everyday payment phenomenon will impact valuation.

There’s bound to be bumps in the road, a look at the infrastructure behind El Salvador’s Chivo Wallet (see below) makes it clear that it will be a sophisticated challenge to operate at a national currency level, but great things have never been easy.

A recent leak of the alleged architecture behind El Salvador’s soon-to-be-released “Chivo” Wallet:

If you can see the path that Bitcoin is on you have one of the most “unfair advantages” in history. If you can’t yet, book a call with me.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

One Year Later

The Gigachad keeps stacking relentlessly and virtually unchallenged. It’s hard to believe that other corporations have not yet started taking pages from Saylor’s well-publicized playbook. I for one think this year-long victory lap —in which he has managed to accumulate a staggering 0.5% of the total Bitcoin supply— is well deserved.

Billions and Billions!

Altcoins are the noise distracting you from the signal. Pay attention:

DEX’d

A DEX is a Decentralized Exchange, ie. one that depends on a network of participants to run (like Bitcoin). Centralized services have the advantage of having no single head to cut off, no server to shut down, no headquarters to raid, ie they are censorship resistant.

The fact that Jack Dorsey (of Twitter and Square fame) is thinking of enabling one and open t conversation with one of the most established DEXes out there (Bisq) is incredibly hopeful.

Centralized (normal) exchanges are subject to legal / political pressure in ways that DEXes may not be. Giving the growing whiff of totalitarianism in the air and the particularly the evident hunger for monetary control displayed by global authorities, DEXes need to be pushed to the forefront.

Institutions Bitcoining

The groundwork for mass adoption keeps advancing as legacy players continue to bake Bitcoin into their offerings

Billionaires Bitcoining

It’s no secret that Ricardo Salinas Pliego, one of Mexico’s richest men, is a Bitcoin enthusiast (he claims to have 10% of his liquid assets in Bitcoin). But still it’s nice to wealthy people actually doing their homework and taking the time to understand what they’re getting into. Bravo Don Ricardo.

Countries Bitcoining

For different reasons and in different ways, nation states are sarting open up to Bitcoin.

Cuba just announced is will be working to regulate Bitcoin as an accepted payment method.

El Salvador is leading the world in being the First Nation to adopt Bitcoin as legal tender less than two weeks from now, on September 7th.

Trading Africa

Africa is leading global peer-to-peer trading volume for Bitcoin, not as part of a government’s plan but despite of it.

Getting Down To ASICS

Further integrating its wide array of offerings, Blockstream will now be producing mining ASICs —the specialized, single purpose computers designed to mine Bitcoin.

Manufacturing ASICs out of China seems like a wise strategic move.

You Are Early

Sometimes people don’t believe me when I tell the they’re still early to Bitcoin…

Substacking Sats

Popular newsletter platform Substack announced it’ll be allowing creators to charge in Bitcoin using Lightning.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Real ETH, Please Stand Up

The Ethereum blockchain split last week, but you wouldn’t know it from looking at the price.

ETFs - ETH

Speaking of Ethereum, two applications for two Ethereum ETFs were quietly withdrawn leading some to speculate whether SEC’s Gary Gensler’s recent comments in Aspen (which included labeling most alts being securities) rattled some nerves and sparked hope that a Bitcoin Futures ETF could be approved sooner rather than later

And if you’re wondering about all the crypto ETFs that have ever been filed and their status, here you go:

Iran No ban

It was announced that the ban on Bitcoin mining will be lifted near the end of September

Visa Apes In

In what could probably be called a great advertising move, Visa bought an NFT to show it’s one of the cool kids.

China: MOAR Crackdown

Not content with the damage already inflicted, China decreed there would be more crackdowns and declared Bitcoin worthless. Bold move.

Of course, China’s definition of “valuable” may not be the same as yours.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Losing the Faith

The majority of financial executives think fiat will be replaced by digital assets which could mean cryptos or CBDCs (Central Bank Digital Currencies). If you’ve done your homework you know it means Bitcoin

Seize This

I remember it took me a while to understand why some people pitched Bitcoin as a technology empower people through property rights.

If you’ve ever struggled with the concept ask yourself how many Berliners are thinking they should have bought Bitcoin instead of that rental unit:

Muh Stonks

The market has been on a historically long upward tear.

Or has it?

Turns out, much depends on how you measure it. If you subtract inflation, then not so much and if you measure it in Bitcoin definitely not. Here’s a chart of the S&P:

I recommend you visit the site above (Inflationchart) and play with the “As Measured In” parameter at the top to compare S&P performance against different assets/commodities.

Dinosaurs Yell At Meteors

Surprising no one, the IMF doesn't’t think Bitcoin can / should be a national currency. Alex Gladstein picks the argument apart in this thread.

Out with the Old

Pour one out for Gold, the venerable hard money of antiquity. I forgone still like and appreciate Gold, but I also believe it will cede much of its monetary premium to Bitcoin (if Bitcoin were to eat ALL of Gold’s monetary premium it would be priced close to $500k)

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

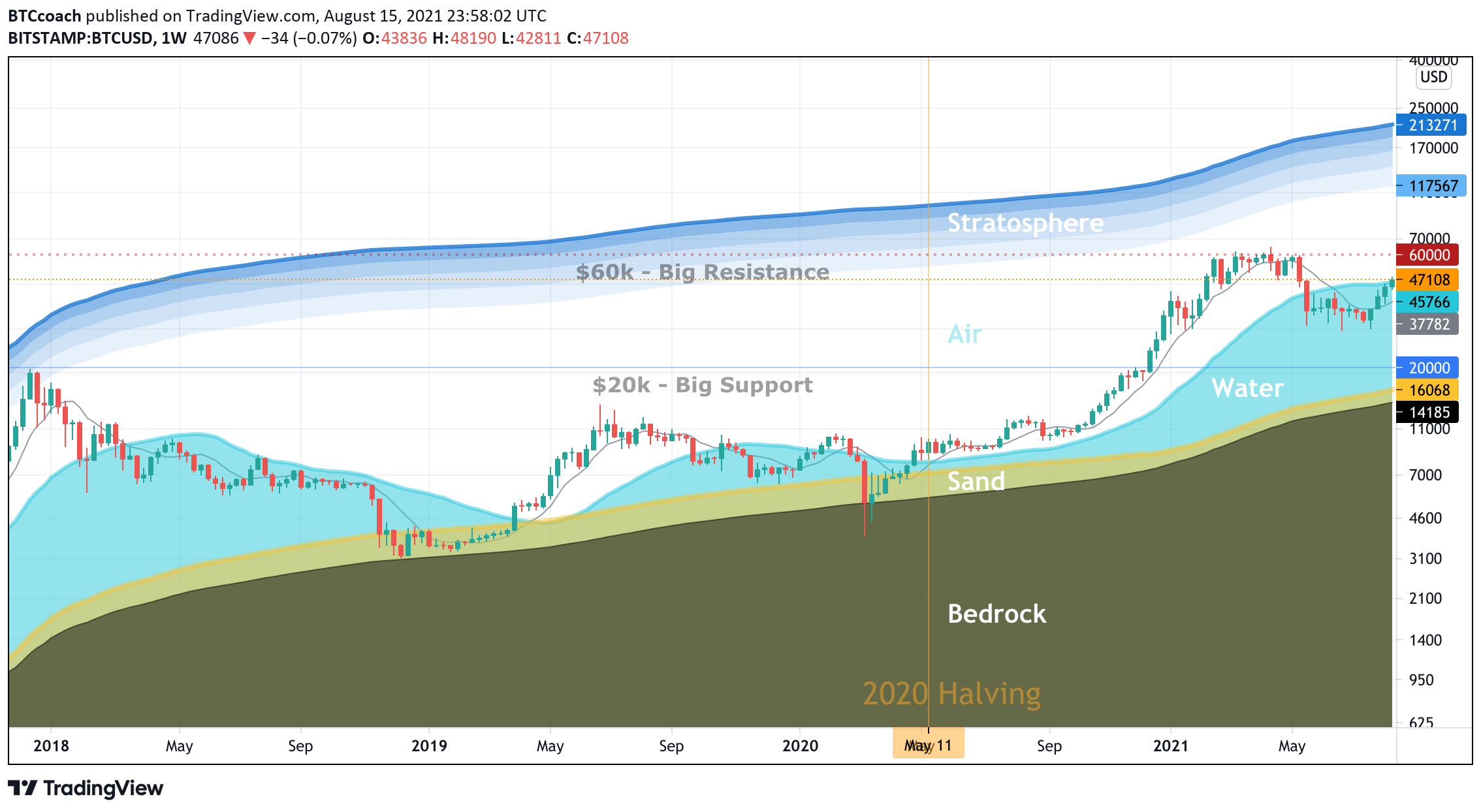

Bitcoin surfing

Bitcoin managed to keep itself above water (currently $46k) and

The Blowoff

Previous parabolic advances in Bitcoin have culminated in blowoff tops (in the Bitcoin Surfing chart that would mean one or more candles penetrating the stratosphere) and many expect this bull run to end in one as well, which is why it’s worth familiarizing yourself with them.

A blow-off top is a chart pattern that shows a steep and rapid increase in a security’s price and trading volume, followed by a steep and rapid drop in price. —Investopedia

David P. Ellis brings the analysis:

Dip Fishing

Bitcoin made a half-hearted attempt at $50k this week and was rejected. It’s currently bound between $46k and $50k We’ll see if it manages to breaks out in either direction.

The Calm Chart

Below is a great description of the Calm Chart:

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.33 - Breach

[ Institutions Bitcoining ][ Celebrities Bitcoining ][ Politicians Bitcoining ][ Evolution ][ Mining USA ][ China: Bitcoin is Property ][ Global Hacked ][ Cyber, Attacked? ][ Metallic Manipulation ][ Only Bans ] [ “Higher” Said Icarus ][ Road to Serfdom ]

TLDR:

Too Long Didn’t Read, aka The Summary

Boundaries are pre-human technology. They can be physical, chemical, conceptual, static or dynamic. Old boundaries are crumbling right now, the race to establish new perimeters is on.

THE STANCE

My personal opinion on where the ball might be heading.

Bitcoin is one of many technologies tearing at old boundaries. Biotechnology, AI, the Internet, Big Data, Robotics and Wireless are a few examples of other techs doing the same.

It’s beyond the scope of this newsletter to try and spell out how the inevitable intersections between the above technologies could be troublesome and dangerous but then again, it shouldn’t be that difficult to imagine that those intersections, which are being very actively explored, could significantly redraw the boundaries of the human experience for good and bad.

I chose to focus on Bitcoin because I believe money —the technology that allows for human cooperation at scale— is a foundational base-layer for civilization and healthy money provides better incentive structures than sick money.

The properties of “natural” (Gold-fueled) money led to it being co-opted by paper money —which started as a proxy for Gold. The properties of paper money let to it being co-opted by (Debt-fueled) fiat money. The properties of fiat money are already showing its limitations, first to those who knew where to look and increasingly to everyone except those making an effort not to see.

The eventual collapse of the fiat system has been called by some “mathematically inevitable”. You may (or not) agree with that statement but ultimately, the dilemma remains:

If the hull of your boat is breached and it becomes obvious it will sink before reaching its destination, you either had a Plan B or you did not.

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Institutions Bitcoining

Are like a steady drumbeat than a panicked rush, we continue to see large institutions —some of which were vocally anti-Bitcoin less than 12 months ago— jostling for position within the Bitcoin ecosystem.

Some are old and have the patina of the venerable about them, others are young, scrappy and tech-savvy. All the same they keep coming.

Celebrities Bitcoining

Bitcoin also keeps growing among the hip, the elite and the famous. As a group the fabulous have been largely unable to resist the siren call of shitcoinery. The exceptions have been notable and celebrated.

Politicians Bitcoining

A more recent trend has been that of politicians realizing Bitcoin could be something their voters care about. Again, motivations here vary wildly in this realm, but overall it’s good to see Bitcoin start to carry some political weight.

For others Bitcoin seems to offer a life after politics. Hopefully this should feed back into the system favorably.

“Just because we’re decentralized that doesn’t have to mean that we’re disorganized”

—Michael Saylor

Evolution

Contrary to what you’ll read in “cryptotwitter”, Bitcoin has a flourishing ecosystem. It’s true that things don’t change as quickly as they do in other projects, but that is a feature not a bug.

You want a monetary system with solid foundations and steady steps, the “move fast and break things” attitude is fine for networks where you share pictures of your food, not for the network for storing global wealth.

Mining USA

In it’s thirst for control China lost a decisive advantage in Bitcoin mining and all that hash power is looking for home. Bitcoin mining in the US is growing by leaps and bounds.

China: Bitcoin is Property

It seems a Chinese court has determined that Bitcoin is property. This would be a positive development in light of the recent apparent hostility towards Bitcoin in China.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Global Hacked

One of Japan’s larger cryptocurrency exchanges —Liquid Global— was hacked. The damages are estimated at over $90 Million. If you don’t yet have Bitcoin under your own custody, you should book a call with me ASAP.

Cyber, Attacked?

Once again a WEF “prediction” seems to edge closer. They predicted a “cyber pandemic” (think Covid for the internet) and right on cue, the high-level attack warning lights started flashing.

This is one of those alerts that sounds very serious, yet provides zero real info on the alleged attack, which may have occurred two weeks ago:

“For security reasons, we are not in a position to discuss the nature or scope of any alleged cybersecurity incidents at this time." —Anonymous State Department spokesperson

Let’s call this one a test run on our nervous system, shall we?

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Metallic Manipulation

The manipulation of the Gold and Silver markets lost its crazy conspiracy status years ago when several traders from some of the most “reputable” houses were charged with manipulating the gold, silver, platinum and palladium markets over the course of eight years

Apparently JPMorgan itself is now off the hook after having paid $920 million and admitting they’d been naughty. I’m sure they’ve learned their lesson and will never do it again.

Only Bans

The polarizing platform OnlyFans —which rose to fame by allowing scores of thots “girls next door” to break into adult entertainment from the comfort of home— has been pressured by payment processors to crack down on pornography.

“Higher” Said Icarus

The stock market, auto debt, bond purchases by the Fed and the Fed’s balance sheet, all continue to rise to unprecedented levels.

Per Holger Zschaepitz, the global market cap is now equal to 139% of global GDP. Economic reality, common sense or math need not apply.

Road to Serfdom

Most people can’t imagine what would be SO bad about CBDCs (Central Bank Digital Currencies), they’d be like crypto but backed by the Government! What’s not to love right?

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Bitcoin Surfing

Bitcoin managed to put the entire body of its weekly candle above the water level (currently at $46k) putting it officially out in the air again, suggesting the $47-$120k range is now in play. Let’s catch some wind!

Dip Fishing

I’d expect Bitcoin to spend the week hanging in the $50-55k area, but it could certainly dip back and spend more time retesting the $49 to $41k area.

I don’t think it will dip below $41k again. Do you?

The Calm Chart

All signs point to a green candle for August.

Now take two deep breaths as you drink in the chart below, you’re going to be just fine.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.32 - Mandatory

[ Happy Birthday ][ Bitcoinversary ][ Of Bitcoin and Lobsters ][ Too Soon? ][ Unmoored ][ The Institutional March ][ Clueless ][ Unamended ][ Muh DeFi ][ Pay No Attention ][ Us and Them ][ Too Much of a Good Thing ][ Euro Go BRRRR ][ El Tango Bitcoin ]

TLDR:

Bitcoin is voluntary, no one can shove it down your throat (believe me I’ve tried). But I suggest you make it an urgent point to educate yourself on it, or you WILL be stuck with the mandatory alternative.

THE STANCE

My personal opinion on where the ball might be heading.

It seems that one word will define 2021: “Mandatory”.

The word is at the heart of the social contract between people, drawing the line between what is expected and what will be enforced. The very boundary of individual freedom beyond which lies violence and coercion.

One of the primary virtues of Bitcoin is that it has grown into an alternative monetary system voluntarily and peacefully adopted by millions of people.

Thus some shockwaves were felt when Bitcoin-Twitter newcomer Jason Lowery put forth the provocative thesis that Bitcoin was digital violence.

I very much enjoyed the first thing I read from him equating military power to a Proof of Work network which helps establish consensus over the legitimate state of property, and I understand his point about POW mining’s energy usage as a defensive projection of force against potential attackers.

I disagree with him in his point that Bitcoin is not voluntary, although I see where he’s coming from (captured well in Saifedean’s quote below). He states that Bitcoin will absorb a significant portion of other Stores of Value therefore if you don’t adopt Bitcoin, Bitcoin will “steal your wealth”.

But this is not a given or the result of an automatic process. It’s a projection from someone who understands Bitcoin as the superior Store of Value and extrapolates that vision into a future where everyone agrees with him. We are nowhere near close to that yet as this simple-but-effective chart from Croesus illustrates:

Many immediately wrote Jason off as a spook, which he very well might be (as a member of the Space Force and “Director of Operations Supporting National Security” he certainly seems to have the qualifications for it), but Bitcoin is money for enemies after all.

At least his advice for the US Government is sensible:

So, I don’t consider Bitcoin to be mandatory in the sense that it should be forced on anyone. I do consider it mandatory for myself to become informed about Bitcoin’s risks, benefits and the potential outcomes of failing to adopt a defensive Bitcoin position and I encourage you to do the same.

If you haven’t given much thought to the collapse of fiat, the following FICTIONAL thread is worth reading to get a feel for what the dollar failing could look like in real life:

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Happy Birthday

50 years ago, President Nixon “closed the gold window”, which means the USD —which had been enshrined as the global reserve currency under the promise that it would be convertible to gold— had ceased to be a proxy for gold. In that moment the era of the gold standard officially ended and the fiat era was born.

Like all moneys, Fiat has its strengths. One of these is allowing governments to “borrow from the future”. This ability has been exploited so egregiously that we are coming up against its social and mathematical limits. The collapse of the fiat system is a “when not if” kind of deal and this is one of the reasons we say that, while there are risks associated with owning Bitcoin, the greater risk is owning zero.

Call me naive, but the fact that this was retweeted by a sitting US Senator gives me hope.

One of the systems that has allowed the USD to thrive is called the petrodollar and it’s a key piece to making sense of much of what happens in Geopolitics. As the US pulls out of Afghanistan in less-than-dignified circumstances it’s worth remembering why it was there in the first place:

Bitcoinversary

One-year ago a news item landed on Twitter with very little splash. A (let’s be real) mostly unknown but public corporation called Microstrategy had adopted a Bitcoin standard.

Soon after Michael Saylor made his very first Bitcoin interview in Pomp’s podcast, which I’ve linked below.

After the first interview, Saylor followed an aggressive schedule of interviews and Bitcoin accumulation that demonstrated a tremendous level of both understanding and conviction in Bitcoin. It’s incredible to think that one year later, there are no other major corporations that are following his playbook.

I know there are Bitcoiners who mistrust Saylor because he understands diplomacy. I am grateful for his efforts, advocacy and clarity of thought. If you’ve never listened to him you’re missing out and should hit “Play” below:

Of Bitcoin and Lobsters

For a long time now, several Bitcoiners have been wanting to jump on a session with Jordan Peterson to talk about Bitcoin. Last week, a few of the got to do just that.

While this interview would not be my first choice to send to someone new to Peterson or Bitcoin —which is unfortunate— it’s a great and wide-ranging conversation around money in general, with Bitcoin represented as the best version humanity has produced.

Too Soon?

For years, valid concerns have been raised about the stablecoin Tether —a cryptocurrency pegged to the dollar so that 1USDT = 1USD.

Ostensibly the way the peg is maintained is by the issuing company always keeping a one-to-one reserve of actual dollars for every unit of Tether it prints. We’ve now known for some time that, despite their claims, Tether is not fully backed, giving rise to heated speculation regarding “how backed” it actually is (more on this below) with some convince that Bitcoin’s price is being artificially pumped using Tether with zero backing.

Because of the way Tether works, the “minting” of new Tether is just like work-in-process inventory. They have “stock” at the ready but it’s not in the market yet. However, shortly after the alert, $200M of these were transferred to Bitfinex and $270M to FTX.

While I don’t subscribe to the theory that “Bitcoin only pumps because Tether”, there is a lot about Tether that looks, sounds, smells and moves and quacks shady. The 21 million Bitcoin question is: Just how unbacked is it?

Unmoored

Speaking of the Tether, last week, Moore Cayman (a Cayman based “Audit and Assurance” service firm whose website lists 10 employees) issued an opinion stating they believe Tether is sufficiently backed, with two key ass-covering provisions:

This was based on a “snapshot” of their assets which covers a specific moment in time, not historical data over a period of any length

Their opinion does not constitute an assurance regarding the absence of fraud or error.

It’s hard to know how seriously we can take this report.

If you want a more detailed view of this latest attestation, you can follow this link to see the charts that Protos put together from the Moore Cayman report.

My key takeaways from this whole thing are:

Either Tether is in better shape than its critics fear or they are digging themselves into a deeper grave by brazenly lying despite regulators breathing down their neck.

A good portion of their reserves are supposed to be in commercial paper but since they seem to be largely unknown in the US bond market the speculation that a significant portion of this paper could be in Chinese firms could make sense.

Since Moore’s attestation was based on Tether’s purchase costs of said paper —and given the poor recent performance of Chinese paper— their reserves could be worth significantly less than the number quoted in the report.

The Tether saga continues to unfold among threatening noises coming from regulators —who fear that Tether and other stablecoins could force the Fed to come to the rescue if things go bad.

The story and value proposition of Bitcoin is much larger than Tether, but it’s undeniable that if they collapse the shockwaves would be significant, but keep in mind all big players are aware of this, so at least some of the risk should be priced in.

The Institutional March

The tempo of the drums rises and falls, but it does not stop. Corporations keep turning to Bitcoin (and crypto). This is not going to stop.

Clueless

I have to admit I refused to participate in the clickbait and I am posting this without reading the article which Twitter reminds me is a major sin. However the headline is unforgivable and deserves only ridicule. If you don’t understand why you need to book a call with me ASAP.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Unamended

Last week saw a frenzied attempt to pass an infrastructure bill in the US. The surprising sticking point for this massive bill turned out to be a small portion of the bill focused on cryptocurrency regulation.

Several amendments were proposed and despite the momentum they generated across both sides of the aisle, they were ultimately blocked under the pettiest of excuses.

Muh DeFi

An unidentified hacker executed (and later reversed) the largest (>$600M) cyber-theft in history by hacking Poly Network platform focused on “blockchain interoperability”.

As part of the response to the attack Tether froze $33 in USDT tokens involved in the hack, showing that there’s no “De” in DeFi, you’re just switching from trusting dudes in suits to trusting dudes in hoodies.

Pay No Attention

The ruling class knows the music is about to stop. The fiat system’s relentless mining of the future’s wealth is about to hit a wall. Hard.

When that happens there will be Chaos. Not a little. Not somewhere.

In their infinite wisdom they think it’d be best if they “manage the transition”, understandable since this is the sort of transition that tends to produce powerful heads mounted on spikes.

And after all, if you were tasked with taking control of a planet, how would you do it without losing your head?

A dream scenario would be having absolute control over both money and people. But how do you get people to go along with it?

We’ll discuss the control of the money another time, but CBDCs (Central Bank Digital Currencies) re being developed with the explicit purpose of gaining absolute control of the money.

As for controlling people, well first you need a good inventory.

Enter the Digital ID:

Us and Them

It starts with narrative control which is used to engender divisiveness. Then demonization which leads to persecution which usually culminates in bloodshed. I hope we can avoid repeating this pattern.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Too Much of a Good Thing

Reverse Repo operations spiked again. This basically means banks have so much cash they don’t know where to park it.

This suggests that the Fed should ease off on the QE as it’s losing its effectiveness. As I’ve written before, the Fed may have unlimited ammo but if they shoot too frequently each shot makes the next bullet softer until eventually they are shooting cotton balls.

Stoney makes an important point: One of the casualties of this mess is pricing. By bending the markets out of shape the Fed causes prices to carry less information leading decision-making astray.

Euro Go BRRRR

The ECB (European Central Bank) keeps growing its balance sheet

El Tango BitcoiN

Nothing solid yet at all, but Argentina’s president (unlike his Central Bank) seems open to exploring Bitcoin as a reserve currency. Open-mindedness is a positive first step.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Bitcoin Surfing

Bitcoin has poked its nose out of the water ($45.7k) and now its board needs to catch up with it again to give it support (currently at $37.7k).

Bitcoin needs to stay above the surface before it can catch some air again, I think that’ll be the big test for this week.

Dip Fishing Chart

Not much to report here, we crossed over the $41k mark and despite all the regulatory noise and the failure to ament the crypto portion of the Infrastructure bill Bitcoin kept going up steadily and by some accounts organically (not a ton of leverage or Tether printing). Next up, $50k

The Calm Chart

Take two deep breaths as you allow your eyes to drink in this chart and remember: You’re going to be just fine.

Conviction comes from understanding

Maybe you don’t have a couple of hours each day to keep up with Bitcoin. But you do have 15 minutes per week.

Subscribe NOW. It’s free

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.31 - Snare

[Wasn’t it Banned?] [Invesco Knows] [JP Morgan] [Stronghold] [The Bill] [Gensler’s House] [What’s in your Wallet?] [Passing on T-Bills] [Reverse Repo] [Chart of Awesomeness]

TLDR:

The current infrastructure bill being discussed will attempt to regulate Bitcoin. Some think it’s the beginning of the government capturing Bitcoin. Others believe Bitcoin will capture the politicians, the market seems to agree with the latter.

THE STANCE

My personal opinion on where the ball might be heading.

Every government will have to define its stance on Bitcoin at some point. From a naive, zoomed-out perspective it seems obvious that they should oppose Bitcoin as it undermines their ability to control monetary policies and all its associated perks (which are significant).

A more nuanced perspective, reveals a couple of interesting facts:

Even highly-dictatorial governments have struggled to ban Bitcoin effectively.

The reign of the USD will not last forever and there is no clear successor in sight.

At the individual level, betting on the wrong horse would be disastrous —especially if your enemies backed the winning horse.

I definitely don’t expect the government to be helpful in any way, shape or form. But I applaud those who try to steer them into causing less damage than they could. I see it all as ways to bide our time, the thing to never forget about Bitcoin is that it becomes stronger when people behave in ways that protect their self-interest.

It takes time for people to see and understand it, but once they realize they can’t kill it they’ll realize it’s the only life-boat in a ship that’s taking water.

Politicians that try to capture Bitcoin are in for a surprise.

For a long and very cogent discussion on this topic, check out the episode of Tales from the Crypt linked below:

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Wasn’t it Banned?

Bitcoin’s trading volume in Africa has been off the charts:

There are several good reasons for this (the article linked in the tweet goes into some of them), but Nigeria’s attempt at banning Bitcoin has turned out to be a big boost. Every failed attempt at killing Bitcoin makes it less likely that other countries will attempt the same.

“They know they can’t really stop it. It’s out of their control, and what scares them is they are not used to being in this position.”

— Out of control and rising: why bitcoin has Nigeria’s government in a panic, The Guardian

Invesco Knows

Atlanta based, Invesco —an Investment Management giant— just filed for a Bitcoin ETF.

What is noteworthy about their filing is that it is aligned with recent guidance from SEC’s Gary Gensler.

Gensler prefers Bitcoin ETFs to be based on Bitcoin futures (which means filing under 40 act) rather than being a pure BTC play (filing under the 33 Act, which is what most US Bitcoin ETFs filed under).

More on Gensler’s perspective below but it seems a Bitcoin ETF will not be approved in the US until a firmer regulatory framework is put in place.

JP Morgan

Jamie Dimon may talk a big game about not liking Bitcoin, but that’s not stopping his firm from offering BTC to their largest clients. As per usual, NYDIG is in on the play.

Stronghold

Bitcoin mining in the US is becoming a force to be reckoned with, all the more reason to pay attention to regulations that could try to impose impossible burdens on this nascent industry.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

The Bill

Last week I commented on the nonsensical idea of trying to squeeze last-minute crypto regulations into an already huge infrastructure bill. Why would they do this?

One explanation: taxing “crypto” more seemed like a convenient piggy-bank that would allow them to fund the project they’re really interested in:

Surprising no one, it’s been a circus.

One of the major issues with the bill came from the vague definition of “broker”. The definition in the original text was far too broad and would have created an unworkable and unenforceable situation.

I was going to comment on the proposed amendments etc, but the process is sufficiently convoluted and farcical that I’m fed up with trying to make sense of it.

If you want to try to follow it help yourself with the tweet below and may G-d have mercy on your soul:

There have been at least two major flavors in the discussions I’ve seen between Bitcoiners, one has been about steering the process to get the least-bad possible result, the other has been about rejecting / ignoring the process altogether

One interesting (and unlikely) development was that the White House was pushing for an amendment which specifically carved out a safe space for Proof-of-Work mining (the type used to mine Bitcoin).

In the thread below Log Scale connects the dots and reaches the conclusion that the Biden Administration is laying down the groundwork to eventually adopt Bitcoin in some capacity.

Gensler’s House

SEC Chair Gary Gensler gave a talk at the Aspen Institute this week, discussing the national security implications of cryptocurrencies emphasizing the importance of protecting investors against fraud and manipulation. He expressed specific concerns about trading, lending, and DeFi.

He also said it was unlikely that more than a handful (5-10) tokens would pass the Howie test (meaning most of them would be classified as securities) and while he made it clear that they didn’t have the manpower to go after each of these projects you can be sure they’ll be sitting down with the exchanges that list them.

He also said attention would need to be paid to the role of cryptocurrencies regarding sanctions, tax compliance and money laundering.

Below you can see a brief summarized video or the full (1 hr) talk.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

What’s in your Wallet?

While it would seem that the stock market has been on an unending rally, things look a little different if we price them in gold instead of USD

A similar exercise comparing USD prices to Bitcoin is also revealing.

In short, the USD is losing value. And it seems I’m not the only one who thinks so…

Passing on T-Bills

The world’s largest pension fund just reduced it’s allocation to US Treasuries by 12%

The kicker is that instead it allocated to sovereign debt from three European countries, two of which have negative rates.

Reverse Repo

If you haven’t heard of reverse repos yet you probably will soon. I’ve mentioned them before as one part of the financial system’s “plumbing” which has been gurgling recently.

This video explains what they are, how they work and some of the ways they can run into trouble.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Chart of Awesomeness

Shoutout to the creator of this beautiful chart!

Bitcoin Surfing

Not content with climbing back on its board (currently at $37.3), Bitcoin used its new perch to give a little jump.

We’ll see if it manages to break the water’s surface (currently at $45.6k) this week despite the legislative shenanigans.

Dip Fishing

Bitcoin finally re-entered “Low” territory, I would expect it to rang here for a while before attacking “Moderate”.

A negative outcome on the infrastructure bill could well push it back into “Surprising” territory.

Dylan believes the bounce off of the “No” line has been organic (not caused by heavy leverage), which would be very bullish.

The Calm Chart

OK, take two deep breaths as you drink in this chart. All we need is a little patience, we’re going to be just fine.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.

DON’T TRUST, VERIFY

Always DYOR (Do Your Own Research)

I am not a financial, tax or legal advisor. All of my content is intended for educational purposes and should not be construed as financial advice

2021.30 - Squeezed

Banking on Bitcoin // Mining IRA // Et Tu Aramco? // Bigger Lightning // Paypal Super-App // Ambitious Jasmine // Infrastructure Attack // Clutching Pearls // Ay Jalisco // Transitory… // Good Plumbing // Cashless Nirvana // Unconfirmed Khazakstan

TLDR:

First they ignore you,

then they laugh at you,

then they fight you, (we are here)

then you win. (we are also here)

—Mahatma Gandhi

THE STANCE

My personal opinion on where the ball might be heading.

For the past few weeks we’ve seen all manner of Bitcoin FUD fly though the screens. This week a real threat reared its head —hidden deep inside a 2,500 page infrastructure bill.

The odds that politicians are going to take the time to read through the bill and actually push to make sensible changes are estimated at Haaaahahahaaaa.

It’s not going to happen, the fight is on.

The price of Bitcoin mustn’t have heard of the bad news though. Dan Tapiero summarizes it well:

So what’s going on?

Beyond the short-term price action and the squeezes (more on this in the Price Action section) and the pumps and the dumps there’s a mostly silent groundswell underneath the noise.

Those with a trained ear to the ground know what it means. The battle may not be over yet but we’re winning.

Despite the headlines, people are slowly, steadily and increasingly accumulating Bitcoin. Institutions make big splashes when they enter and exit, many of those paper-handed whales will sell as soon as they get scared or turn a large enough profit, we’ve already seen both of these things happen.

But the number of orange-pilled individuals who understand not just the potential upside of owning Bitcoin, but the potential downside of not owning enough is growing. These are people who are not going to change their mind on fiat, there’s no stopping this tide.

You may think this is just my opinion, but Pi Prime Pi brought the receipts:

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Banking on Bitcoin

News of institutional interest keeps rolling in. State Street is the second oldest bank in the USA.

Golden Tree taking a Bitcoin position is interesting as they are mostly into debt (bonds). In my opinion this lends weight to Greg Foss’ narrative of Bitcoin as insurance against default by Fiat denominated instruments.

Mining IRA

Thanks to an agreement between Choice and Compass Mining, you can now to mine Bitcoin directly into your IRA tax free. If you are a US person, I’d highly advise you look into this.

Et Tu Aramco?

Unconfirmed as of now, but there are rumors that the Saudi behemoth Aramco (3rd largest company in the world) is looking into mining Bitcoin.

Brazilian Bitcoin miner Ray Nasser allegedly said in an interview:

“We are negotiating with Aramco. All black liquid [oil] that comes out of the desert belongs to this company. All the flared gas they’re not using, and that’s public information, I can tell you, it’s enough to ‘power up’ half of the Bitcoin network today, from this company alone,”

Let’s hope this rumor doesn’t wind up like last week’s Amazon rumor, which turned out to be false.

Bigger Lightning

The capacity of the lightning network keeps growing rapidly. Most people are still sleeping on the Lightning network, but I predict once it breaks into the mainstream, it’ll land with the subtlety of thunder.

Paypal Super-App

Ever since it entered the Bitcoin space a few months ago, PayPal has been upping its game. First they announced users would be able to move their coins to their own wallets, then they increased buying limits and now they are setting to release a “super app wallet”

“The super app wallet will feature high yield savings, early access to direct deposit funds, messaging capability, “additional crypto capabilities” and more…”

—Turner Wright, Cointelegraph

Ambitious Jasmine

The Bitcoin mining space is heating up so much we may boil the polar bears after all (it’s sarcasm, people).

The Thai giant Jasmine Telecom Systems (JTS) announced ambitious plans to become: “the largest Bitcoin miner of the ten nations comprising the Association of Southeast Asian Nations (ASEAN).” —Alex McShane, Bitcoin Magazine

It seems they are basically trying to capitalize on China fumbling the ball with Bitcoin mining. Good for them.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

ATTACK

The Bitcoin community has long been expecting an attempt from the Government to capture Bitcoin.

"The bottom line is that this regulatory storm has been brewing years. The crypto industry should have done more to head it off. Now, it may be too late."

— Jeff John Roberts, Executive Editor Decrypto.co

This week we got the opening salvo:

How it Started:

How it’s going:

It seems the government’s strategy will be to pass draconian regulations that will make pretty much everyone in crypto an outlaw.

At first glance it would seem odd that they would sneak crypto-regulation into a mammoth bill that is mostly about roads and bridges (classic US politics though), but they make the argument that they’ll fund some of this work by squeezing $28 billion (out of the $550 billion in this bill) by squeezing the crap out of the crypto industry.

If this bill goes through as planned we are all in for a wild ride. Some of these provisions may prove be impossible to enforce for Bitcoin, but other (centralized) crypto projects might not get off so easily.

A strict interpretation of these new rules would throw an icy-cold bucket of water on the US’ flourishing Bitcoin mining industry and would be as large a gaff as the one China just recently committed.

I can only imagine other countries are licking their chops at the prospect of capturing the US’ share of the Bitcoin mining industry.

Clutching Pearls

Surprising absolutely no one, the powers that be were not amused by El Salvador’s adoption of Bitcoin as legal tender.

The pushback continues with a milquetoast finger-wagging article by the IMF and a downgrade from Moody’s.

Ay Jalisco

Mexico is cracking down on unregistered exchanges.

Adding insult to injury, the regulators flipped a fat middle finger to Jalisco’s vibrant startup culture by implying the activity was the result of narco money.

I am struck by the fact that many of the cryptocurrency platforms are installed in several municipalities in the state of Jalisco,”

— Santiago Nieto Castillo, Head of Mexico’s Financial Intelligence Unit (UIF)

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —Being "short / bearish" means betting it will go down in value.

Transitory…

The markets are supposed to collapse the infinitely complex state of the economy into a few simple vectors of information, like prices and interest rates.

When the government (or the Fed) intervenes in the markets, it unavoidably distorts said information. For example, the Fed is buying US treasuries as part of their QE (Quantitative Easing) program.

One could argue that in doing this they are turning debt into cash, also called monetizing the debt:

“This process may make it seem as if the Treasurys bought by the Fed don't exist, but they do exist on the Fed's balance sheet. Technically, the Treasury must pay the Fed back one day. Until then, the Fed has given the federal government more money to spend, increasing the money supply, and monetizing the debt.”

The Fed argues that it isn’t really monetizing the debt because these measures (QE) are temporary —more on this below— but regardless of how we define its actions, the end result is what we need to understand:

“The Fed wanted QE to revive the housing market. Low-interest rates also reduce returns on bonds, which turns investors toward stocks and other higher-yielding investments. For all these reasons, low interest rates help boost economic growth.”

— How the Fed Monetizes US Debt, The Balance

I ran the above quote through my BS-Extraction software and this came out:

“By making savings unprofitable, the Fed is forcing everyone to incur additional risk by requiring people to become investors / speculators if they wish to preserve the purchasing power of their money.”

This alone would be bad enough, but then we were gifted with the Fed Chair’s attempt at defining “transitory” and it’s hard not to feel like our chain is being pulled:

Despite the Fed’s soothing assurances, it seems those darned corporations are not buying into the “transitory” nature of inflation:

Good Plumbing

Good plumbing should be out of sight and out of mind.

You know how many billions of USD fit in a single Bitcoin block?

All of them.

Cashless Nirvana

Oh what a joy deeply negative yields would be. One of the many reasons to lust after a CBDC. Once a central has absolute control over your money it can impose a number of creative mechanisms (like expiration dates and negative interests) to make you dance like their financial puppet.

Cash and Bitcoin are in the way of this glorious vision. They are already working on destroying cash, Wonder what comes next?

Unconfirmed Khazakstan

Potentially positive. Will wait for details.

PRICE DISCOVERY

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Squeezing Shorts

You may have heard we had a nice short squeeze this week:

What does this mean?

In simple terms, a bunch of people were betting that price would keep dropping. But despite the slew of negative news, price started to go up. This forces the shorts to decide between taking a loss now or waiting to see if price drops again.

If they decide to wait and price keeps rising their loss will be even greater. If they decide to take their loss they need to buy at the new, higher price which creates increased upward pressure on price and can trigger a chain reaction of sorts, called a short squeeze.

Dip Fishing

Price rebounded sharply off of the “No” boundary as a short-squeeze propelled prices all the way to the boundary between “Surprising” and “Low” where it was denied admission.

We will see where price settles. I’ve heard a lot of “supply shock” commentary suggesting moon is imminent, I think it will take a little longer before Bitcoin takes off again.

One thing is for sure, you should be taking your coins off the exchanges and into your wallet. If you are not confident about how to do this, book a call with me below.

Bitcoin Surfing

Bitcoin was able to get back on the board (currently sitting at $35.7k), it’s next challenge is to stay on the board and ride it back above the surface ($45k).

If you recall, back in July 5th, I wrote that it was unlikely that July would print a red monthly candle (4 red monthly candles in a row would be unprecedented in a bull run), and boy did it look like I was going to be wrong for the first half of the month!

But price rallied and managed to print a modest green candle to break the red streak. Now we have a fresh month and all bets are off. I still expect a massive run up before the end of the year, but I’m not yet convinced this was the start of it.

The Calm Chart

I’ve added (hopefully discreet) monthly candles to The Calm Chart, I hope they don’t harsh your mellow.

Now take two deep breaths as you drink in the chart below.

We’re going to be just fine.

Strong hands are best built TOGETHER.

I work with families, groups and individuals, helping them develop the knowledge and confidence to invest in Bitcoin safely.

All it takes is a few conversations.

Schedule a call to see if one of my plans is a good fit for you.