2021.32 - Mandatory

TLDR:

Bitcoin is voluntary, no one can shove it down your throat (believe me I’ve tried). But I suggest you make it an urgent point to educate yourself on it, or you WILL be stuck with the mandatory alternative.

THE STANCE

My personal opinion on where the ball might be heading.

It seems that one word will define 2021: “Mandatory”.

The word is at the heart of the social contract between people, drawing the line between what is expected and what will be enforced. The very boundary of individual freedom beyond which lies violence and coercion.

One of the primary virtues of Bitcoin is that it has grown into an alternative monetary system voluntarily and peacefully adopted by millions of people.

Thus some shockwaves were felt when Bitcoin-Twitter newcomer Jason Lowery put forth the provocative thesis that Bitcoin was digital violence.

I very much enjoyed the first thing I read from him equating military power to a Proof of Work network which helps establish consensus over the legitimate state of property, and I understand his point about POW mining’s energy usage as a defensive projection of force against potential attackers.

I disagree with him in his point that Bitcoin is not voluntary, although I see where he’s coming from (captured well in Saifedean’s quote below). He states that Bitcoin will absorb a significant portion of other Stores of Value therefore if you don’t adopt Bitcoin, Bitcoin will “steal your wealth”.

But this is not a given or the result of an automatic process. It’s a projection from someone who understands Bitcoin as the superior Store of Value and extrapolates that vision into a future where everyone agrees with him. We are nowhere near close to that yet as this simple-but-effective chart from Croesus illustrates:

Many immediately wrote Jason off as a spook, which he very well might be (as a member of the Space Force and “Director of Operations Supporting National Security” he certainly seems to have the qualifications for it), but Bitcoin is money for enemies after all.

At least his advice for the US Government is sensible:

So, I don’t consider Bitcoin to be mandatory in the sense that it should be forced on anyone. I do consider it mandatory for myself to become informed about Bitcoin’s risks, benefits and the potential outcomes of failing to adopt a defensive Bitcoin position and I encourage you to do the same.

If you haven’t given much thought to the collapse of fiat, the following FICTIONAL thread is worth reading to get a feel for what the dollar failing could look like in real life:

LONG BITCOIN

Recent news that keeps me bullish on Bitcoin —"long / bullish" means you have the expectation something will rise in value.

Happy Birthday

50 years ago, President Nixon “closed the gold window”, which means the USD —which had been enshrined as the global reserve currency under the promise that it would be convertible to gold— had ceased to be a proxy for gold. In that moment the era of the gold standard officially ended and the fiat era was born.

Like all moneys, Fiat has its strengths. One of these is allowing governments to “borrow from the future”. This ability has been exploited so egregiously that we are coming up against its social and mathematical limits. The collapse of the fiat system is a “when not if” kind of deal and this is one of the reasons we say that, while there are risks associated with owning Bitcoin, the greater risk is owning zero.

Call me naive, but the fact that this was retweeted by a sitting US Senator gives me hope.

One of the systems that has allowed the USD to thrive is called the petrodollar and it’s a key piece to making sense of much of what happens in Geopolitics. As the US pulls out of Afghanistan in less-than-dignified circumstances it’s worth remembering why it was there in the first place:

Bitcoinversary

One-year ago a news item landed on Twitter with very little splash. A (let’s be real) mostly unknown but public corporation called Microstrategy had adopted a Bitcoin standard.

Soon after Michael Saylor made his very first Bitcoin interview in Pomp’s podcast, which I’ve linked below.

After the first interview, Saylor followed an aggressive schedule of interviews and Bitcoin accumulation that demonstrated a tremendous level of both understanding and conviction in Bitcoin. It’s incredible to think that one year later, there are no other major corporations that are following his playbook.

I know there are Bitcoiners who mistrust Saylor because he understands diplomacy. I am grateful for his efforts, advocacy and clarity of thought. If you’ve never listened to him you’re missing out and should hit “Play” below:

Of Bitcoin and Lobsters

For a long time now, several Bitcoiners have been wanting to jump on a session with Jordan Peterson to talk about Bitcoin. Last week, a few of the got to do just that.

While this interview would not be my first choice to send to someone new to Peterson or Bitcoin —which is unfortunate— it’s a great and wide-ranging conversation around money in general, with Bitcoin represented as the best version humanity has produced.

Too Soon?

For years, valid concerns have been raised about the stablecoin Tether —a cryptocurrency pegged to the dollar so that 1USDT = 1USD.

Ostensibly the way the peg is maintained is by the issuing company always keeping a one-to-one reserve of actual dollars for every unit of Tether it prints. We’ve now known for some time that, despite their claims, Tether is not fully backed, giving rise to heated speculation regarding “how backed” it actually is (more on this below) with some convince that Bitcoin’s price is being artificially pumped using Tether with zero backing.

Because of the way Tether works, the “minting” of new Tether is just like work-in-process inventory. They have “stock” at the ready but it’s not in the market yet. However, shortly after the alert, $200M of these were transferred to Bitfinex and $270M to FTX.

While I don’t subscribe to the theory that “Bitcoin only pumps because Tether”, there is a lot about Tether that looks, sounds, smells and moves and quacks shady. The 21 million Bitcoin question is: Just how unbacked is it?

Unmoored

Speaking of the Tether, last week, Moore Cayman (a Cayman based “Audit and Assurance” service firm whose website lists 10 employees) issued an opinion stating they believe Tether is sufficiently backed, with two key ass-covering provisions:

This was based on a “snapshot” of their assets which covers a specific moment in time, not historical data over a period of any length

Their opinion does not constitute an assurance regarding the absence of fraud or error.

It’s hard to know how seriously we can take this report.

If you want a more detailed view of this latest attestation, you can follow this link to see the charts that Protos put together from the Moore Cayman report.

My key takeaways from this whole thing are:

Either Tether is in better shape than its critics fear or they are digging themselves into a deeper grave by brazenly lying despite regulators breathing down their neck.

A good portion of their reserves are supposed to be in commercial paper but since they seem to be largely unknown in the US bond market the speculation that a significant portion of this paper could be in Chinese firms could make sense.

Since Moore’s attestation was based on Tether’s purchase costs of said paper —and given the poor recent performance of Chinese paper— their reserves could be worth significantly less than the number quoted in the report.

The Tether saga continues to unfold among threatening noises coming from regulators —who fear that Tether and other stablecoins could force the Fed to come to the rescue if things go bad.

The story and value proposition of Bitcoin is much larger than Tether, but it’s undeniable that if they collapse the shockwaves would be significant, but keep in mind all big players are aware of this, so at least some of the risk should be priced in.

The Institutional March

The tempo of the drums rises and falls, but it does not stop. Corporations keep turning to Bitcoin (and crypto). This is not going to stop.

Clueless

I have to admit I refused to participate in the clickbait and I am posting this without reading the article which Twitter reminds me is a major sin. However the headline is unforgivable and deserves only ridicule. If you don’t understand why you need to book a call with me ASAP.

CRYPTO WARS

crypto- | ˈˌkrɪpˌtoʊ | concealed; secret.

The monopoly over fiat money will not be given up without a fight.

Unamended

Last week saw a frenzied attempt to pass an infrastructure bill in the US. The surprising sticking point for this massive bill turned out to be a small portion of the bill focused on cryptocurrency regulation.

Several amendments were proposed and despite the momentum they generated across both sides of the aisle, they were ultimately blocked under the pettiest of excuses.

Muh DeFi

An unidentified hacker executed (and later reversed) the largest (>$600M) cyber-theft in history by hacking Poly Network platform focused on “blockchain interoperability”.

As part of the response to the attack Tether froze $33 in USDT tokens involved in the hack, showing that there’s no “De” in DeFi, you’re just switching from trusting dudes in suits to trusting dudes in hoodies.

Pay No Attention

The ruling class knows the music is about to stop. The fiat system’s relentless mining of the future’s wealth is about to hit a wall. Hard.

When that happens there will be Chaos. Not a little. Not somewhere.

In their infinite wisdom they think it’d be best if they “manage the transition”, understandable since this is the sort of transition that tends to produce powerful heads mounted on spikes.

And after all, if you were tasked with taking control of a planet, how would you do it without losing your head?

A dream scenario would be having absolute control over both money and people. But how do you get people to go along with it?

We’ll discuss the control of the money another time, but CBDCs (Central Bank Digital Currencies) re being developed with the explicit purpose of gaining absolute control of the money.

As for controlling people, well first you need a good inventory.

Enter the Digital ID:

Us and Them

It starts with narrative control which is used to engender divisiveness. Then demonization which leads to persecution which usually culminates in bloodshed. I hope we can avoid repeating this pattern.

SHORT FIAT

Recent news that makes me bearish on the legacy financial system —"short / bearish" means betting it will go down in value.

Too Much of a Good Thing

Reverse Repo operations spiked again. This basically means banks have so much cash they don’t know where to park it.

This suggests that the Fed should ease off on the QE as it’s losing its effectiveness. As I’ve written before, the Fed may have unlimited ammo but if they shoot too frequently each shot makes the next bullet softer until eventually they are shooting cotton balls.

Stoney makes an important point: One of the casualties of this mess is pricing. By bending the markets out of shape the Fed causes prices to carry less information leading decision-making astray.

Euro Go BRRRR

The ECB (European Central Bank) keeps growing its balance sheet

El Tango BitcoiN

Nothing solid yet at all, but Argentina’s president (unlike his Central Bank) seems open to exploring Bitcoin as a reserve currency. Open-mindedness is a positive first step.

PRICE DISCOVERY

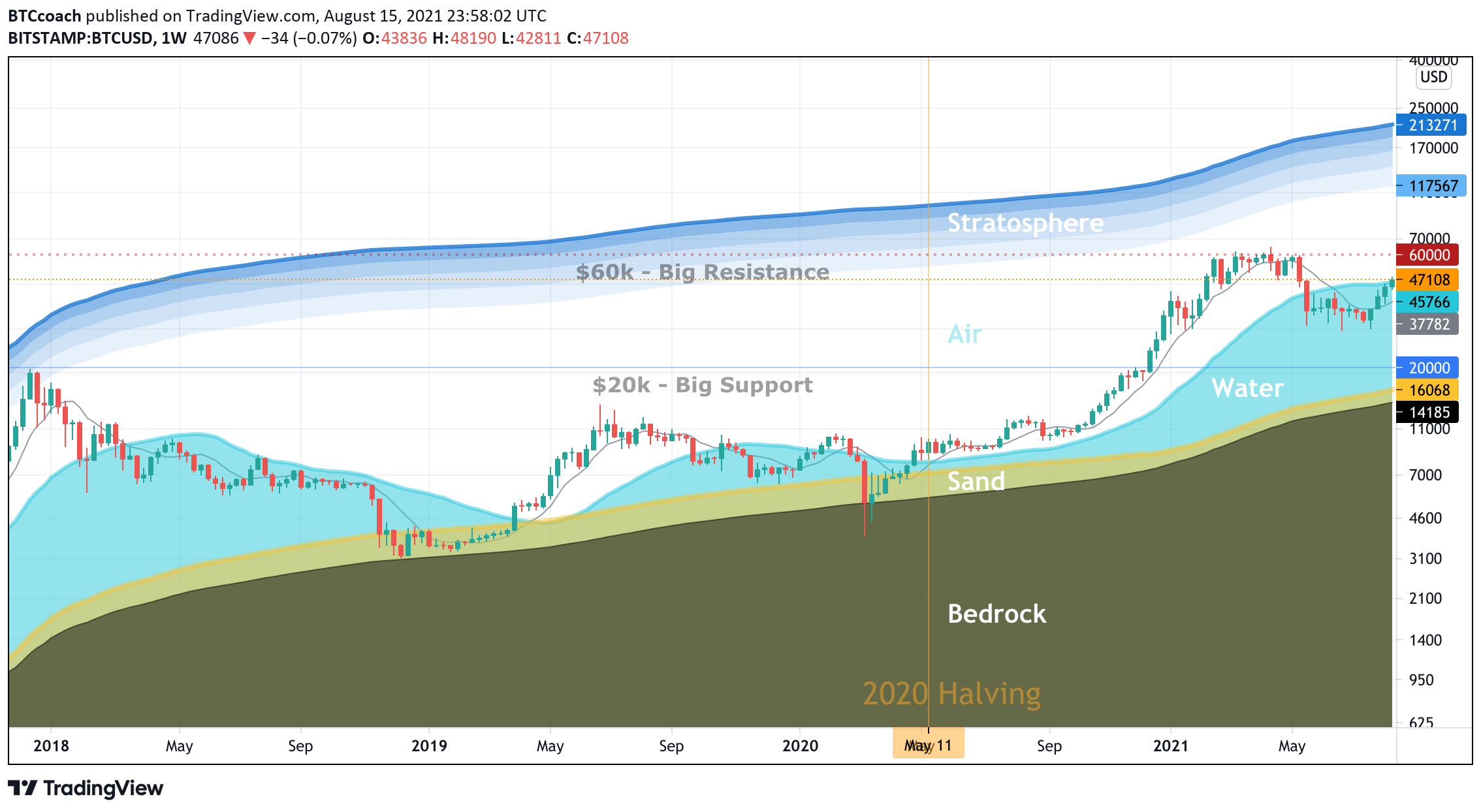

This is the section where I talk about price with an updated weekly price chart. If this is your first time here, there’s a “how to interpret” guide below the chart.

Bitcoin Surfing

Bitcoin has poked its nose out of the water ($45.7k) and now its board needs to catch up with it again to give it support (currently at $37.7k).

Bitcoin needs to stay above the surface before it can catch some air again, I think that’ll be the big test for this week.

Dip Fishing Chart

Not much to report here, we crossed over the $41k mark and despite all the regulatory noise and the failure to ament the crypto portion of the Infrastructure bill Bitcoin kept going up steadily and by some accounts organically (not a ton of leverage or Tether printing). Next up, $50k

The Calm Chart

Take two deep breaths as you allow your eyes to drink in this chart and remember: You’re going to be just fine.

Conviction comes from understanding

Maybe you don’t have a couple of hours each day to keep up with Bitcoin. But you do have 15 minutes per week.

Subscribe NOW. It’s free